Going Sailing

Dryer sheet aficionado

So back in 2010 we returned from a year of sailing and had some left over cash in a tax deferred account. Market returns were not impressive.

A friend had developed a computer trading system. Backtested 30% returns etc. etc. He was doing it on the side for fun, but wanted to show real returns with real capital to market his system to hedge funds.

I dumped some money in ($108k) and thought what the heck, we'll give it try buying 10 stocks on the TSE and making trades once or twice a week. In 15 years I would be able to buy an NHL Hockey team!

Within a year we had turned it in to ~$80k.

But by 2014, I had more than doubled the original investment. Rather than stay fully in the game to buy the hockey team, I pulled out all my original investment.

Now playing with "house" money, I thought what the heck now I can leave it in guilt free and see what comes of it.

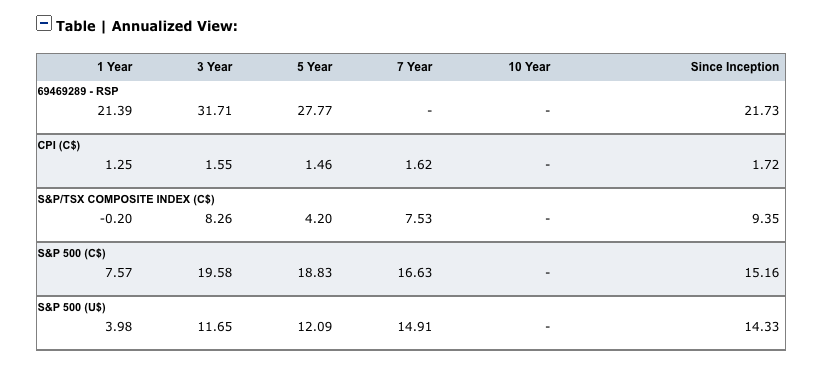

Now 630 trades in, the fun money has a five year annualized rate of return of 27.7% (21.73% since inception with the first year dip). It's running 8% shy of the backtest performance, so a hockey team would be a long way away, but still better than the TSX at 9.35% over the same time period.

The problem with "house" money is it's not "house" money. It's my money, and I have to consider its place in a portfolio regardless of source. Especially since I want to retire soon. I don't want a large percentage of my invested assets in volatile resource and energy stocks.

So I am about to rebalance again and pull some money out to put in the broader diversified pool of index funds. Sadly realizing that my fun money will never turn into something big! A $30k loss would represent a year of cruising funds.

I'll still keep it at the level of $100k as I enjoy the game and need to have a certain level to have decent returns after trading fees. But all the fun will be in pointing to a rate of return rather than a giant pool of funds.

My friend has since gone on to an exclusive license to a hedge fund after adapting the model to American markets. I remain grandfathered and able to play in Canada for as long as I want. (Or as long as the thing continues to work - once millions of dollars start chasing the same little stocks, the gains will disappear.)

A friend had developed a computer trading system. Backtested 30% returns etc. etc. He was doing it on the side for fun, but wanted to show real returns with real capital to market his system to hedge funds.

I dumped some money in ($108k) and thought what the heck, we'll give it try buying 10 stocks on the TSE and making trades once or twice a week. In 15 years I would be able to buy an NHL Hockey team!

Within a year we had turned it in to ~$80k.

But by 2014, I had more than doubled the original investment. Rather than stay fully in the game to buy the hockey team, I pulled out all my original investment.

Now playing with "house" money, I thought what the heck now I can leave it in guilt free and see what comes of it.

Now 630 trades in, the fun money has a five year annualized rate of return of 27.7% (21.73% since inception with the first year dip). It's running 8% shy of the backtest performance, so a hockey team would be a long way away, but still better than the TSX at 9.35% over the same time period.

The problem with "house" money is it's not "house" money. It's my money, and I have to consider its place in a portfolio regardless of source. Especially since I want to retire soon. I don't want a large percentage of my invested assets in volatile resource and energy stocks.

So I am about to rebalance again and pull some money out to put in the broader diversified pool of index funds. Sadly realizing that my fun money will never turn into something big! A $30k loss would represent a year of cruising funds.

I'll still keep it at the level of $100k as I enjoy the game and need to have a certain level to have decent returns after trading fees. But all the fun will be in pointing to a rate of return rather than a giant pool of funds.

My friend has since gone on to an exclusive license to a hedge fund after adapting the model to American markets. I remain grandfathered and able to play in Canada for as long as I want. (Or as long as the thing continues to work - once millions of dollars start chasing the same little stocks, the gains will disappear.)