I liked it better when I wasnt clicking on "view post" too.

I dont have a burr under my saddle about the fund. Its just painfully obvious that a lot of people dont understand the fund, what it invests in, what those investments are good for, and they dont have very good expectations. But that hasnt stopped them from buying in and then exhorting others to do the same.

For conservative investors, this fund contains a lot of speculative elements that just ran up a lot in price. They could just as easily run back down.

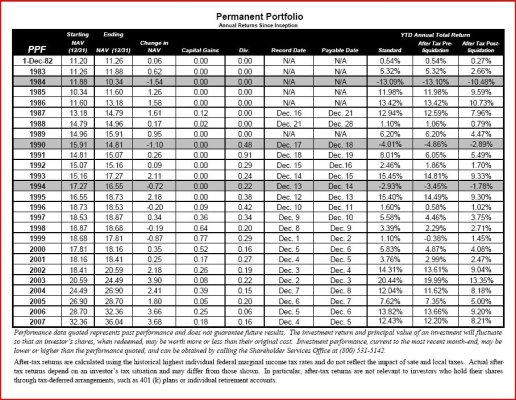

Who cares about 20 year old results? Gosh, many people here rely on Firecalcs analysis of data from the last 140+ years to determine their potential success. In fact I'd propose that someone who buys investments base purely on their 5 year trailing results is a few courses short of having a clue about investing.

Do you imagine the folks who bought a bunch of QQQQ's in early 2000 after seeing them go up 400% over the prior 5 years slept well at night? How do you think they were doing around 2002?

One last time: buy low, sell high.

I dont really expect to change your mind since the facts seem to be getting in the way of what you think. But I'd sure like to make sure other people take the time to look at investments like this and walk away with knowledge and good expectations. Not just look at the last five years performance, get excited and throw their money into it.

Here's the section from the funds prospectus regarding risk. Note that the current level of highly volatile elements of this fund (gold, silver, real estate, equity, currency) is well in excess of 60%.

Not exactly a CD. My favorite part is down at the bottom where they note that if a bunch of people sell the fund all at once, they might pay you in the gold coins the fund is holding instead of cash. I wonder if you have to show up somewhere to get your bag of coins or if they ship them to your house?

"Principal Investment Risks. An investment in the Permanent Portfolio is not guaranteed; you may lose money by investing in the Permanent Portfolio. Even if the Permanent Portfolio does achieve its investment objective over the long term, it is subject to the risk of suffering substantial short-term losses from time to time, because investment prices generally respond to changes in the pattern of inflation with lags and delays that are impossible to foresee. The principal risks of investing in the Permanent Portfolio are:

• Risks of investments in gold and silver – gold and silver generate no interest or dividends, offering only the potential for price appreciation. Investments in gold and silver are subject to special risk considerations, including substantial price fluctuations over short periods of time, and are affected by various factors, such as economic conditions, political events and monetary policies.

• Risks of investments in Swiss franc assets – the Swiss franc is subject to the risk that inflation will decrease in the United States, or rise in Switzerland. Swiss government bonds are subject to some risk of default, and their credit quality is not rated by U.S. rating agencies.

• Risks of investments in real estate and natural resource companies – any decline in the general level of prices of oil or real estate would be expected to have an adverse impact on these stocks. The prices of such stocks are particularly vulnerable to decline in the event of deflationary economic conditions.

• Risks of investments in aggressive growth stocks – investments in aggressive growth stocks are subject to both market risk and capitalization risk. Market risk is the risk that the value of the Portfolio’s investments will fluctuate as the stock market fluctuates and that prices overall will decline for short- or long-term periods. Aggressive growth stock investments are subject to greater market risk of price declines, especially during periods when the prices of U.S. stock market investments in general are declining. Capitalization risk is the risk that investment in companies with smallto

mid-capitalization tend to be more volatile than investments in large-capitalization companies. The Portfolio’s investments in small- and mid-capitalization companies may have additional risks because such

companies often have limited product lines, smaller customer bases and fewer financial resources than larger companies.

• Risks of investments in Dollar assets – investments in U.S. Treasury securities are subject to interest rate risk. This is the risk that changes in interest rates will affect the value of the Portfolio’s investment in U.S. Treasury securities. Prices of U.S. Treasury securities fall when prevailing interest rates rise. Price fluctuations of long-term U.S. Treasury securities are greater than price fluctuations for shorter term U.S. Treasury securities, and may be as extensive as the price fluctuations of common stock. Investments in corporate bonds are subject to both interest rate risk

and credit risk. See “Principal Investment Risks” for the Versatile Bond Portfolio below for a discussion of these risks.

• Risks of investing in foreign and emerging markets – many foreign stock markets are not as developed or efficient as those in the U.S., and securities of some foreign issuers may be less liquid and more volatile than securities of

comparable United States companies. In general, there is less overall governmental supervision and regulation of securities exchanges, brokers, banks and listed companies; less publicly available information about securities; and accounting and auditing standards often may be less strict and less reliable than in the United States.

• Risks of in-kind redemptions – to avoid liability for corporate federal income tax, the Portfolio must, among other things, derive at least 90% of its gross income each year from items including interest, dividends and gains on sales

of securities. Gains on sales of gold and silver by the Permanent Portfolio would not qualify as “gains on sales of securities.” Consequently, profitable sales of gold and silver (as might be required for the Permanent Portfolio to

adhere to its Target Percentages) could subject the Portfolio to liability for corporate federal income tax. To try to reduce this potential adverse tax result, the Fund may require redeeming shareholders in the Permanent Portfolio to accept readily tradable gold or silver bullion or coins from the Portfolio’s holdings in complete or partial payment of redemptions, if it can satisfy a federal tax law provision that permits it to do so without recognizing gain. See “Redemption of Shares–In-Kind Redemptions” below."