Mulligan

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

- Joined

- May 3, 2009

- Messages

- 9,343

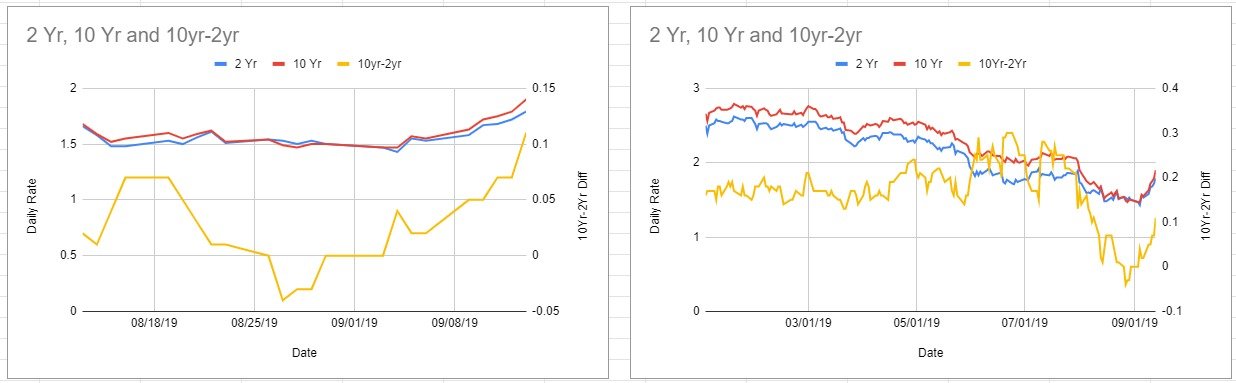

Remember I was one of the few people predicting that rates would invert and the 10 year would break through the 2016 low and the 30 year would break 2%. People like Jamie Dimon told investors to prepare themselves for a 10 year yield of 4.75% by then end of 2019. I still believe rates are going to go lower which will put a lot of strain on banks, especially the regional banks. Look what's going on with European banks. They are breaching their 2008 lows and the one's that haven't are about to.

Recall back about 3 years ago that I posted on this thread that something is going on this this retail sector and things are not as healthy as Wall Street believes. Shops were empty but retail stocks were rallying. That sector 3 years later has caused so much pain and is about to cause even more of a bruising.

The bottom line is that there is too much consumer debt out there for rates to move higher. People on this board are by nature more financially responsible and assume subconsciously that the rest of the world is like them. But the vast majority are clueless when it comes to personal finances and are under severe financial stress due to excessive debt. You have to ask yourself who is going to fuel consumption going forward, the savers or the people drowning in debt.

That is why I roughly stay between 50-100% ute preferreds. But then again I always have. I dont allocate much to the higher risk. Still rates are going to stay historically low, but I think we can see some leveling off here. Wage increases starting to pick up, fully employed, economy is still chugging along.