|

|

04-04-2016, 04:06 PM

04-04-2016, 04:06 PM

|

#301

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Dec 2008

Location: On a hill in the Pine Barrens

Posts: 9,720

|

Quote: Quote:

Originally Posted by steelyman

I thought it was encouraged to use e-r.org to post reminders to themselves to make stock trades. I supposed that was for those who hadn't learned that gigabytes of Internet space are theirs for the asking these days.

|

It helps most who read the thread. It's all good.

|

|

|

|

Join the #1 Early Retirement and Financial Independence Forum Today - It's Totally Free!

Are you planning to be financially independent as early as possible so you can live life on your own terms? Discuss successful investing strategies, asset allocation models, tax strategies and other related topics in our online forum community. Our members range from young folks just starting their journey to financial independence, military retirees and even multimillionaires. No matter where you fit in you'll find that Early-Retirement.org is a great community to join. Best of all it's totally FREE!

You are currently viewing our boards as a guest so you have limited access to our community. Please take the time to register and you will gain a lot of great new features including; the ability to participate in discussions, network with our members, see fewer ads, upload photographs, create a retirement blog, send private messages and so much, much more!

|

04-04-2016, 04:15 PM

04-04-2016, 04:15 PM

|

#302

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Apr 2003

Location: Hooverville

Posts: 22,983

|

Quote: Quote:

Originally Posted by Gone4Good

I don't know who might keep data on this. But my guess is that buybacks went from somewhere north of "a lot" in 2007 to right around "very little" in 2009.

|

This is correct.Cash dividends may decrease, but buybacks usually disappear under financial stress. Even though this is just the time to pile on. I guess the managers really do not want to hurt for money to keep operations going.

Ha

__________________

"As a general rule, the more dangerous or inappropriate a conversation, the more interesting it is."-Scott Adams

|

|

|

04-04-2016, 06:20 PM

04-04-2016, 06:20 PM

|

#303

|

|

Thinks s/he gets paid by the post

Join Date: Sep 2006

Posts: 2,844

|

In general companies since 1998, when the FED began the rapid decline in interest rates have been increasing debt and buying shares and paying dividends, to the point where capital investment as a share of profits is now at a 60 year low. Meanwhile since 1998 dividends and sharebuybacks are averaging 95% of profits

But McKinsey, the great company that has been the main advisor and source of structuring of companies for Valeant and McKinsey thinks this is the best measure of corporation value. The COO of Sun Edison is from McKinsey, which famously had a study on Solar saying the winner will be the company that could most rapidly obtain size and Pearson also from McKinsey who argued R&D in the pharma drug industry is a waste of money and could be more profitably exploited by buyouts of companies and then cutting the costs of the acquired company. Both are similar in that the need to actually know how to do something is viewed as less important than financing through corporate purchases and borrowing, but is I think a natural consequence of extremely low interest rates since the return to cover interest is negligible, that is until you can no longer get any more funds nor roll your debt, then it all collapses.

US stock buybacks are killing economic growth

|

|

|

04-04-2016, 09:16 PM

04-04-2016, 09:16 PM

|

#304

|

|

Thinks s/he gets paid by the post

Join Date: Sep 2006

Posts: 2,844

|

See below how in 2014 earnings just stopped going up, to this point companies stepping in and buying stock has reversed every dip but at some point you need earnings....

|

|

|

04-05-2016, 02:23 AM

04-05-2016, 02:23 AM

|

#305

|

|

gone traveling

Join Date: Oct 2007

Posts: 1,135

|

So you're 35% equities with 25 percent of that in individual stocks and the other 10% broad market

Are you specifically looking for an exit point ?

Good posts above by the way in Corp profit. I tend to agree.

I worry that holding cash to me is a losers game longer term. Where are your bond investments if any ? Individual bonds or bond funds ?

|

|

|

04-05-2016, 09:00 AM

04-05-2016, 09:00 AM

|

#306

|

|

Thinks s/he gets paid by the post

Join Date: Sep 2006

Posts: 2,844

|

Quote: Quote:

Originally Posted by papadad111

So you're 35% equities with 25 percent of that in individual stocks and the other 10% broad market

Are you specifically looking for an exit point ?

Good posts above by the way in Corp profit. I tend to agree.

I worry that holding cash to me is a losers game longer term. Where are your bond investments if any ? Individual bonds or bond funds ?

|

Yes I am 35% stocks 25% individual 10% broad index, plan on keeping the 25 as individual as that is enough investment work to maintain those issues. That level is my minimum stock holding level.

35% is just my investment level at the present time, if the market soared to where the valuation upside was below 40% I would most likely go back to 25% but it is just as possible valuation potential could begin moving up again, either through a fall in the market or a rise in profits in which case I would probably begin increasing my ownership in stocks.

Cash is 15% held in ST treasury stock fund, 10 year treasury ladder, 5 year treasury/CD ladder, some individual preferred issues and an annuity with 4% annual step up purchased in 2007. I also own gold.

|

|

|

04-13-2016, 08:13 PM

04-13-2016, 08:13 PM

|

#307

|

|

gone traveling

Join Date: Oct 2007

Posts: 1,135

|

Insightful. Is your WR below 3% ? Still accumulating or in drawdown ?

|

|

|

04-14-2016, 06:45 AM

04-14-2016, 06:45 AM

|

#308

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Sep 2005

Posts: 5,381

|

Quote: Quote:

Originally Posted by Running_Man

In general companies since 1998, when the FED began the rapid decline in interest rates have been increasing debt and buying shares and paying dividends, to the point where capital investment as a share of profits is now at a 60 year low. Meanwhile since 1998 dividends and sharebuybacks are averaging 95% of profits

|

There is quite a mystery to unravel in that. Normally high returns to capital, which is what companies are increasingly earning, would encourage more capital investment. But right now investment is about average to a bit below average relative to the business cycle even as the share of revenue going to corporate profits is near an all-time high.

I wouldn't blame this on the Fed (corporate investment was at a cyclical peak in 1998 and at a two-decade high at that.) And low interest rates are probably a symptom, rather than a cause, as we'll see in a moment.

I'm more sympathetic to Larry Summer's argument that high corporate profits and low relative investment is best explained by increased monopoly power among firms.

Quote: Quote:

If monopoly power increased, one would expect to see higher profits, lower investment as firms restricted output, and lower interest rates as the demand for capital was reduced. This is exactly what we have seen in recent years!

Is the increased-monopoly-power theory plausible? The Economist makes the best case I have seen for it, noting that (i) many industries have become more concentrated, (ii) we are coming off a major merger wave, (iii) there is some evidence of greater profit persistence among major companies, (iv) new business formation has declined, (v) overlapping ownership of companies that compete has become more common with the rise of institutional investors, and (vi) leading technology companies such as Google and Apple may be benefiting from increasing returns to scale and network effects.

|

If that's true, then what we're experiencing is deeply structural and not likely to change any time soon.

__________________

Retired early, traveling perpetually.

|

|

|

04-14-2016, 07:04 AM

04-14-2016, 07:04 AM

|

#309

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Sep 2005

Posts: 5,381

|

Oh, and a market and economy made of companies with increasing monopoly power will exhibit lower investment, lower interest rates, lower economic growth, higher corporate profits, higher equity valuations and higher payouts to shareholders through dividends and share repurchases.

All of that fits with modern day America.

__________________

Retired early, traveling perpetually.

|

|

|

04-14-2016, 07:24 AM

04-14-2016, 07:24 AM

|

#310

|

|

Thinks s/he gets paid by the post

Join Date: Nov 2013

Location: Twin Cities

Posts: 3,941

|

Quote: Quote:

Originally Posted by Gone4Good

If that's true, then what we're experiencing is deeply structural and not likely to change any time soon.

|

Summers makes a lot of sense here. One unusual factor for U.S. firms right now is how strong they are compared with the rest of the world. When that imbalance starts to right itself, I wonder if U.S. firms will be forced to invest in growth to keep competitive?

|

|

|

04-14-2016, 08:36 AM

04-14-2016, 08:36 AM

|

#311

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Sep 2005

Posts: 5,381

|

Quote: Quote:

Originally Posted by Markola

Summers makes a lot of sense here. One unusual factor for U.S. firms right now is how strong they are compared with the rest of the world. When that imbalance starts to right itself, I wonder if U.S. firms will be forced to invest in growth to keep competitive?

|

Only if they face pressure from competitors in their own markets. Monopoly power is all about erecting barriers to that kind of competition.

Here's an interesting tid-bit from the Economist article Summers links to . . .

Quote: Quote:

|

In a market the size of America’s prices should be lower than in other industrialised economies. By and large, they are not. Though American companies now make a fifth of their profits abroad, their naughty secret is that their return-on-equity is 40% higher at home.

|

So both domestic prices and returns are higher in the States than elsewhere and yet domestic investment from all sources is low. That says to me that both foreign and domestic upstarts are having trouble entering the market to compete with established firms.

Clearly the economic incentives to invest in the U.S. are high enough to attract capital. And yet it still sits in huge cash piles or gets returned to shareholders rather than invested. Something's clearly amiss.

__________________

Retired early, traveling perpetually.

|

|

|

04-14-2016, 10:44 PM

04-14-2016, 10:44 PM

|

#312

|

|

Thinks s/he gets paid by the post

Join Date: Sep 2006

Posts: 2,844

|

United States Corporate Profits | 1950-2016 | Data | Chart | Calendar

I cannot take any single thing Lawrence Summers says seriously, as I personally think he has been an advocate and apologist for criminal behavior for people in his employ, but mathematics is math no matter what, the idea that now companies in the US can make all their profits without investing is frankly silly. US Corporate profits are falling not rising and are at 2010 levels, not some new high due to monopoly superpowers, the profitability is falling as anyone would expect with less investment. What is rising is MARGINS to an all time high as by not investing you don’t get new depreciation and it makes current sales look more valuable. For a lesson on how this works in the long run look at Valeant and their “cash earnings” thesis.

There is some new super monopolies creating unbelievable new profitablity? The 10 most profitable companies in the US holding almost 20% of all corporate profits are Apple, Microsoft, Exxon, Chevron, Wells Fargo, JP Morgan Chase, Berkshire Hathaway, Walmart, GE. Most of these have come under tremendous operating pressure at various times since 1998, some needed the US government to bail them out. But the one thing they almost all have in common is adding debt and buying back stock. Monopoly in the US for any of these? I do not see it, they are just as likely to be steamrolled and be driven out of business in the next 10 years.

Apple is living off of the Steve Jobs designed IPHONE, Microsoft is just now turning themselves around to be on the cloud, Exxon and Chevron are in capital preservation mode, JP Morgan and Wells Fargo are seeing their margins and profits squeezed. Walmart is getting steamrolled by Amazon and GE is an industrial giant with a bad earnings announcement in January hoping to stay relevant on the US screen.

Have they all figured out how to corporate engineer margins with lower interest costs and buying back stock? Yes. Are there margins mostly high right now ... Yes. Is every one of these companies in serious potential risk going forward, yes other than Berkshire.

Fortune 500's 10 most profitable companies - Fortune

|

|

|

04-15-2016, 06:07 AM

04-15-2016, 06:07 AM

|

#313

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Sep 2005

Posts: 5,381

|

Quote: Quote:

Originally Posted by Running_Man

US Corporate profits are falling not rising and are at 2010 levels, not some new high due to monopoly superpowers, the profitability is falling as anyone would expect with less investment.

|

Taking a longer view you'll see that corporate profits as a share of GDP are at near record levels and far, far above historic norms.

Quote: Quote:

Originally Posted by Running_Man

Have they all figured out how to corporate engineer margins with lower interest costs and buying back stock? Yes. Are there margins mostly high right now ... Yes. Is every one of these companies in serious potential risk going forward, yes other than Berkshire.

|

But you haven't answered the question. Corporate profits are high by historic standards. Returns on capital are nearly double what they were in the 1980's. And yet you admit yourself that capital investment is low. Why is that?

Low interest rates may explain why corporations are borrowing more. It doesn't explain why they choose to repurchase shares rather than reinvest in businesses that are more profitable than at any time in many decades.

The decision to return cash to shareholders is one undertaken in the absence of higher return investments to make. But that's not the case now. U.S. corporations return on capital is around 16% - far above anyone's WACC.

So why return money to investors at their WACC when the only reason for a corporation to exist is to invest investor's money at better than WACC rates?

The answer is because firms with monopoly type market power restrict output to maximize margins. Monopoly firms also don't need to invest or innovate as much to stay ahead of competition.

And, yes, most every firm you mentioned in your comment works in concentrated industries with high barriers to entry.

Do you ever wonder why large software firms have such huge cash balances? It's to buy smaller rivals so they don't have to compete with them. Do you know why Apple got patent protection (i.e. legal monopolies) on nearly every aspect of the iPhone (including such trivial things as "slide to unlock")? They did it to prevent competition and to extract rents from competitors in court.

Banking? They've collected huge monopoly rents for decades. Ever wonder why a corporate bond salesman makes 10x-20x what a car salesman makes? Or why the "average" employee at Goldman Sachs earns over $200K? Massive barriers to entry keep margins on mundane activities incredibly high.

Berkshire? Buffett's entire investment strategy is to " look for economic castles protected by unbreachable ‘moats’." That's a textbook definition of a company with monopoly power.

__________________

Retired early, traveling perpetually.

|

|

|

04-15-2016, 06:26 AM

04-15-2016, 06:26 AM

|

#314

|

|

Thinks s/he gets paid by the post

Join Date: May 2014

Location: Utrecht

Posts: 2,650

|

Quote: Quote:

Originally Posted by Gone4Good

So why return money to investors at their WAAC when companies only reason to exist is to invest that money at better than WAAC rates?

|

The headroom to grow might be zero. It doesn't matter if I make alot of money selling tobacco if there are no more smokers to be found. Better give shareholders the profits then so they can allocate to other businesses that can still grow. Basically that's what Berkshire does at the corporate level. I wouldn't want a tobacco company to try and enter the software business for example, regardless of potential return. The risk is too high.

Quote: Quote:

Originally Posted by Gone4Good

The answer is because firms with monopoly type market power restrict output to maximize margins. Monopoly firms also don't need to invest or innovate as much to stay ahead of competition.

|

Very true. It's not the only factor I think though. Also, strictly speaking monopolies don't restrict output, they just raise prices. Depending on the price sensitivity of the customer, that may in turn reduce demand.

|

|

|

04-15-2016, 06:27 AM

04-15-2016, 06:27 AM

|

#315

|

|

Administrator

Join Date: Jan 2008

Location: Chicagoland

Posts: 40,714

|

Perhaps US businesses are not investing more because there is not enough aggregate demand and additional capacity is not needed. CEOs are less concerned with profit margins and more focused on earnings per share, which is a primary component of their compensation. Borrowing to buy back shares enables EPS growth where there is no growth in revenue.

|

|

|

04-15-2016, 06:40 AM

04-15-2016, 06:40 AM

|

#316

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Sep 2005

Posts: 5,381

|

Quote: Quote:

Originally Posted by Totoro

The headroom to grow might be zero. It doesn't matter if I make alot of money selling tobacco if there are no more smokers to be found.

|

Even so, in a competitive market where margins are high other competitors will try to grab some of that lucrative market share. Even if demand isn't growing they'll enter the existing market until those excess margins are competed away. The persistence of excess margins is an indication that healthy competition of that sort is somehow limited.

__________________

Retired early, traveling perpetually.

|

|

|

04-15-2016, 07:57 AM

04-15-2016, 07:57 AM

|

#317

|

|

Administrator

Join Date: Jan 2008

Location: Chicagoland

Posts: 40,714

|

Quote: Quote:

Originally Posted by Gone4Good

The persistence of excess margins is an indication that healthy competition of that sort is somehow limited.

|

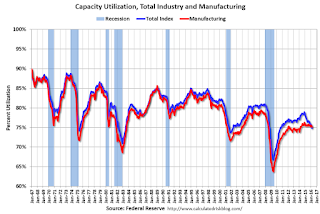

By excess, you mean "high". Limited competition is one explanation for high margins, but there are others. Capacity utilization in the US is low and below it's long term average, and a CEO making a case to the board that a business should expand in a time of excess capacity and slow growing demand would might soon be looking for a new job.

The higher margins coincide with a falling share of labor to total GDP. That makes margins look more the outcome of cost containment rather than monopoly pricing.

|

|

|

04-15-2016, 08:28 AM

04-15-2016, 08:28 AM

|

#318

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Sep 2005

Posts: 5,381

|

Quote: Quote:

Originally Posted by MichaelB

By excess, you mean "high". Limited competition is one explanation for high margins, but there are others. Capacity utilization in the US is low and below it's long term average, and a CEO making a case to the board that a business should expand in a time of excess capacity and slow growing demand would soon be looking for a new job.

The higher margins coincide with a falling share of labor to total GDP. That looks more like cost containment rather than monopoly pricing.

|

But isn't this all counter-intuitive?

Why is capacity utilization low in a time of high margins?

Wouldn't it make sense for the CEO to say "hey, we should use some of this idle capacity we've already paid for to make more widgets?" One reason not to do that is if your marginal revenue already equals your marginal cost, in which case margins should be low instead of high.

Another reason to leave capacity idle is because you have pricing power and can extract a higher total profit by producing fewer units.

And if cost containment is the answer, why hasn't competition resulted in lower prices instead of higher margins?

In competitive markets firms aren't supposed to be able to retain the benefits of efficiencies forever. And that's actually one of the pieces of evidence The Economist sites:

Quote: Quote:

|

An American firm that was very profitable in 2003 (one with post-tax returns on capital of 15-25%, excluding goodwill) had an 83% chance of still being very profitable in 2013 . . . In the previous decade the odds were about 50%.

|

__________________

Retired early, traveling perpetually.

|

|

|

04-15-2016, 09:13 AM

04-15-2016, 09:13 AM

|

#319

|

|

Thinks s/he gets paid by the post

Join Date: Sep 2006

Posts: 2,844

|

Quote: Quote:

Originally Posted by Gone4Good

Even so, in a competitive market where margins are high other competitors will try to grab some of that lucrative market share. Even if demand isn't growing they'll enter the existing market until those excess margins are competed away. The persistence of excess margins is an indication that healthy competition of that sort is somehow limited.

|

Your are attempting to hijack the thread into a discussion of capitalism by twisting a portion of one of my answers, my answer and concern that corporate profitability has stopped going up since 2010 and investment has been limited while stock buybacks continue and that this trend cannot go on forever.

If you have a point to make on why now would be a reason to increase, decrease or stay at your present investment level then I would be glad to here it, but I do not wish to have this change into a political discussion on the need to corral evil monopolies and patents.

|

|

|

04-15-2016, 09:38 AM

04-15-2016, 09:38 AM

|

#320

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Sep 2005

Posts: 5,381

|

Quote: Quote:

Originally Posted by Running_Man

I do not wish to have this change into a political discussion on the need to corral evil monopolies and patents.

|

I'm not making a political argument, I'm making an economic one. If you choose to see anything written here as political, well, I guess that's on you.

And yeah, all of this has relevance to investment decisions as it relates to the sustainability of historically high corporate profit share, without which current equity valuations make no sense whatsoever.

Quote: Quote:

Originally Posted by Running_Man

my answer and concern that corporate profitability has stopped going up since 2010 and investment has been limited while stock buybacks continue and that this trend cannot go on forever.

|

And I guess you missed the point that firms with substantial market power can do just that.

__________________

Retired early, traveling perpetually.

|

|

|

|

|

|

Currently Active Users Viewing This Thread: 1 (0 members and 1 guests)

|

|

|

| Thread Tools |

|

|

| Display Modes |

Linear Mode Linear Mode

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

|

» Recent Threads

» Recent Threads

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

» Quick Links

» Quick Links

|

|

|