OldShooter

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

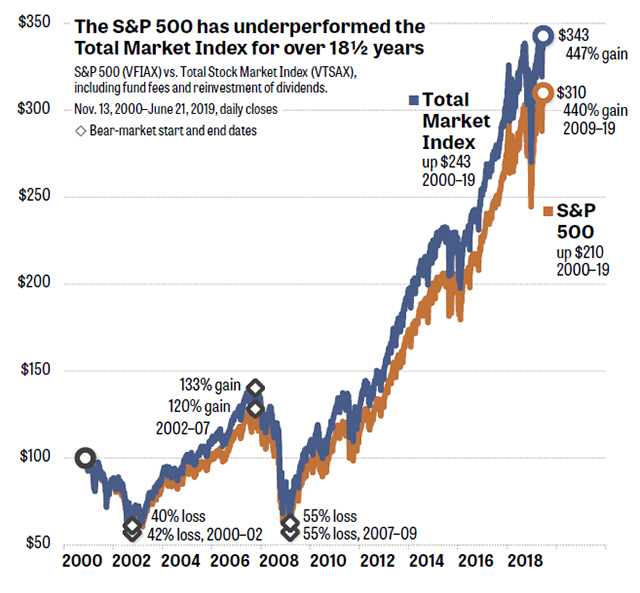

Lots of people here talk about buying S&P 500 funds. In this article, the author compares total market performance to S&P 500 performance for 18 1/2 years and shows that the total market won. I'm not too concerned about that because I expect that other time periods would probably show different results, though I do buy the principle that the total market is the place to be.

But the main reason for the post is that the article does an excellent job of discussing the 20-25% of the market that is not included in the S&P. I have not seen this discussed so clearly before.

https://www.marketwatch.com/story/shocker-the-sp-500-is-underperforming-the-market-2019-06-26

But the main reason for the post is that the article does an excellent job of discussing the 20-25% of the market that is not included in the S&P. I have not seen this discussed so clearly before.

https://www.marketwatch.com/story/shocker-the-sp-500-is-underperforming-the-market-2019-06-26