|

|

04-02-2016, 02:20 PM

04-02-2016, 02:20 PM

|

#61

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Sep 2005

Location: Northern IL

Posts: 26,892

|

Quote: Quote:

Originally Posted by Gone4Good

... That surprised me too. But if you look at Wellesley's portfolio mix, the bond portion is intermediate corporates. If you add Vangaurd's int-corp index to the graph, the relative performance makes a bit more sense.

Corp bonds have done really well over the past 15 years. Much better than I would have thought.

But still, there are periods where a 60% holding of corp's seemed like it should have held them back more than they did.

So, yeah, it looks like the guys and gals at Wellesley are earning their paychecks. |

Yep. And for a little more 'fun' with that chart, I realized just recently that if you adjust the bar for a time frame less than "ALL" (1 year, 2 years, whatever), you can then grab the bar in the middle and slide it left-right, and see how X year performance was across the entire span.

Quote: Quote:

Originally Posted by Mulligan

Thanks for posting that. I was reading the above 3M reference and thinking I knew somebody owned Palm but it wasnt them. ....

|

It took me a minute, but 3Com was based here and I knew people who worked there, and at its earlier incarnation - that was US Robotics (of modem fame).

-ERD50

|

|

|

|

Join the #1 Early Retirement and Financial Independence Forum Today - It's Totally Free!

Are you planning to be financially independent as early as possible so you can live life on your own terms? Discuss successful investing strategies, asset allocation models, tax strategies and other related topics in our online forum community. Our members range from young folks just starting their journey to financial independence, military retirees and even multimillionaires. No matter where you fit in you'll find that Early-Retirement.org is a great community to join. Best of all it's totally FREE!

You are currently viewing our boards as a guest so you have limited access to our community. Please take the time to register and you will gain a lot of great new features including; the ability to participate in discussions, network with our members, see fewer ads, upload photographs, create a retirement blog, send private messages and so much, much more!

|

04-02-2016, 02:33 PM

04-02-2016, 02:33 PM

|

#62

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: May 2009

Posts: 9,343

|

Quote: Quote:

Originally Posted by ERD50

Yep. And for a little more 'fun' with that chart, I realized just recently that if you adjust the bar for a time frame less than "ALL" (1 year, 2 years, whatever), you can then grab the bar in the middle and slide it left-right, and see how X year performance was across the entire span.

It took me a minute, but 3Com was based here and I knew people who worked there, and at its earlier incarnation - that was US Robotics (of modem fame).

-ERD50

|

US Robotics, I havent heard that name in a while....If we keep this up we will eventually be heading toward mentioning Wang Class B shares of stock!

|

|

|

04-02-2016, 03:21 PM

04-02-2016, 03:21 PM

|

#63

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Sep 2005

Posts: 5,381

|

Quote: Quote:

Originally Posted by NW-Bound

The parent company was 3Com, not 3M. I owned 3Com during that time, and watched in amazement the Palm mania.

|

Yup. Memory fades, I guess.

__________________

Retired early, traveling perpetually.

|

|

|

04-02-2016, 03:32 PM

04-02-2016, 03:32 PM

|

#64

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jul 2008

Posts: 35,712

|

It's OK. It happens to all of us, some sooner than others.

Anyway, I would love to know to be a contrarian like Templeton. He made mucho money, and also acted as a stabilizing actor in the market with "helping" other investors: selling when they clamor to buy, buy, buy, and buying when they are desperate to get out at any price. Without contrarians, the market swings would be even more severe.

__________________

"Old age is the most unexpected of all things that happen to a man" -- Leon Trotsky (1879-1940)

"Those Who Can Make You Believe Absurdities Can Make You Commit Atrocities" - Voltaire (1694-1778)

|

|

|

04-02-2016, 04:40 PM

04-02-2016, 04:40 PM

|

#65

|

|

Thinks s/he gets paid by the post

Join Date: Oct 2002

Location: Chattanooga

Posts: 3,893

|

We all know the cliche, how do you make a small fortune in actively managed funds ? Start with a large one.

__________________

Earning money is an action, saving money is a behavior, growing money takes a well diversified portfolio and the discipline to ignore market swings.

|

|

|

04-02-2016, 10:16 PM

04-02-2016, 10:16 PM

|

#66

|

|

Thinks s/he gets paid by the post

Join Date: Jun 2014

Posts: 1,069

|

Quote: Quote:

Originally Posted by youbet

Which single benchmark do you have 100% of your investments in? Are you in, say, 100% S&P 500 so that you can be "guaranteed" at being the benchmark itself?

|

A benchmark is whatever you dream up. Active investing try call winners as subsets.

I allocate across 5 indexes.

Sent from my iPhone using Early Retirement Forum

|

|

|

04-04-2016, 05:29 AM

04-04-2016, 05:29 AM

|

#67

|

|

Recycles dryer sheets

Join Date: Mar 2010

Location: Poway, CA

Posts: 441

|

I am mostly in index funds now, but I still have a few managed funds. I have to keep an eye on them and if one of their managers quits, I move that investment into an index. If I miss this detail I'll move the investment to an index when it does poorly.

Sent from my Nexus 4 using Early Retirement Forum mobile app

|

|

|

Some Active beats Indexing

04-04-2016, 02:59 PM

04-04-2016, 02:59 PM

|

#68

|

|

Thinks s/he gets paid by the post

Join Date: Mar 2014

Location: Southern Cal

Posts: 4,032

|

Some Active beats Indexing

Does BRK/b beat index fund?

Sent from my iPad using Early Retirement Forum

__________________

Just another day in paradise

|

|

|

04-04-2016, 03:07 PM

04-04-2016, 03:07 PM

|

#69

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Mar 2005

Location: Chicago

Posts: 13,186

|

Quote: Quote:

Originally Posted by Fedup

Does BRK/b beats index fund?

Sent from my iPad using Early Retirement Forum

|

BRK/b outperforms many index funds in given time frames. Lately, the dozens of index funds following energy, commodities, almost any international index or domestic small cap index come to mind. Going forward, it's a good guess that BRK/b will beat some of 'em and not others, depending which of the dozens and dozens of indexes and corresponding index funds you're talking about.

If you like the idea of not having taxable divs thrust upon you every year and impacting your tax picture, some folks find BRK/b a reasonable substitute for a dom TSM index fund such as VTI. There is no guarantee that it will stay that way of course.

__________________

"I wasn't born blue blood. I was born blue-collar." John Wort Hannam

|

|

|

Some Active beats Indexing

04-04-2016, 03:21 PM

04-04-2016, 03:21 PM

|

#70

|

|

Thinks s/he gets paid by the post

Join Date: Mar 2014

Location: Southern Cal

Posts: 4,032

|

Some Active beats Indexing

May be I should be specific, the s&p 500 index, I've heard on the news that his funds have not being doing well lately.

Sent from my iPad using Early Retirement Forum

__________________

Just another day in paradise

|

|

|

04-04-2016, 03:32 PM

04-04-2016, 03:32 PM

|

#71

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Mar 2005

Location: Chicago

Posts: 13,186

|

Quote: Quote:

Originally Posted by Fedup

Mane I should be specific, the s&p 500 index, I've heard on the news that his funds have not being doing well lately.

Sent from my iPad using Early Retirement Forum

|

Oh, OK.

BRK/b generally outperformed the S&P 500 index over the past five years. Here's a nice tool to play with and that answers the question.

Berkshire vs. the S&P 500 | Thumbcharts®

BRK/b did have a down 2015, but still ended the five year period ahead of the S&P500 and BRK/b holders had the opportunity to sell at a nice margin over the S&P 500 along the way. How things will work out over the next few years would just be a guess.

I couldn't decide and own some of both (but predominantly TSM)...... There was a nice buying opportunity for BRK/b in January at about $125 and I couldn't resist. We'll see how it works out.

__________________

"I wasn't born blue blood. I was born blue-collar." John Wort Hannam

|

|

|

04-05-2016, 02:09 AM

04-05-2016, 02:09 AM

|

#72

|

|

gone traveling

Join Date: Oct 2007

Posts: 1,135

|

Stock pickers just had their worst quarter ever

http://www.cnbc.com/id/103518291

Much of the past decade has been rough for active fund managers, but 2016 hasn't been just bad, it's been history-making bad.

Fewer than 1 in 5 large-cap funds beat the S&P 500, the lowest level since at least 1998,

For growth-focused funds, the news was even uglier: Just a 6 percent beat rate at a time when the S&P benchmark has gained just over 1 percent year to date.

Value managers did a bit better with a 19.6 percent beat rate,

core funds fared comparatively well, with 29 percent topping the benchmark.

|

|

|

04-05-2016, 06:10 AM

04-05-2016, 06:10 AM

|

#73

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Sep 2005

Posts: 5,381

|

Quote: Quote:

Originally Posted by youbet

|

That chart doesn't look like it includes dividends. And that's a huge illusory advantage for non-dividend paying companies like Berkshire.

Total returns for Vanguard's 500 Index are 73% over the last five years instead of about 50% shown in the chart. BRK looks like it's up about 60% over 5 years, so trailing the S&P 500 total return.

__________________

Retired early, traveling perpetually.

|

|

|

04-05-2016, 07:17 AM

04-05-2016, 07:17 AM

|

#74

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jul 2008

Posts: 35,712

|

Yes, one should be sure to include dividends when comparing stocks.

According to Morningstar, a $10K invested 5 years ago would grow to $17,130 in VFINX (Vanguard flagship S&P MF), and $17,253 in BRK. So they run neck-to-neck the last 5 years.

Over longer terms, Buffett leads big. Morningstar only shows data going back to 8/31/1991, so I took that as the start.

A $10K invested on 8/31/1991 grew to $35K 10 years later (8/31/2001) with S&P and $79K with BRK. It's a factor of 2.26X. This is the period of the tech bubble, and Buffett beat it. Amazing!

Keep the investments for another 10 years, and it became $45K in 2011 with the S&P, and $125K with BRK. The factor has widened to 2.78X.

Keep it till now (4/2016), and it's $84K with the S&P and $245K with BRK. The factor is now 2.91X.

If we can go back further than 1991, BRK would shine even more when it was smaller and Buffett could make more agile moves, and beat the pants off the S&P. From Wikipedia:

Quote: Quote:

|

Berkshire Hathaway averaged an annual growth in book value of 19.7% to its shareholders for the last 49 years (compared to 9.8% from the S&P 500 with dividends included for the same period), while employing large amounts of capital, and minimal debt.

|

That's a return of 2X better, and compounding over 50 years? Oh la la.

But, as I often repeatedly said, no one can beat the S&P every single year. Stand back to look over a bit longer period and you will see the difference.

__________________

"Old age is the most unexpected of all things that happen to a man" -- Leon Trotsky (1879-1940)

"Those Who Can Make You Believe Absurdities Can Make You Commit Atrocities" - Voltaire (1694-1778)

|

|

|

04-05-2016, 07:45 AM

04-05-2016, 07:45 AM

|

#75

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jul 2008

Posts: 35,712

|

I think I have just convinced myself to put all my current cash holding in BRK if the market crashes tomorrow. If any stock could recover from Armageddon, BRK would be leading them.

But until then, I can use my cash to write more puts on BRK. If the market does not crash, that still gives me a bit of return if the option does not get assigned. And if it gets assigned, that will do me good in the long run.

__________________

"Old age is the most unexpected of all things that happen to a man" -- Leon Trotsky (1879-1940)

"Those Who Can Make You Believe Absurdities Can Make You Commit Atrocities" - Voltaire (1694-1778)

|

|

|

04-05-2016, 08:44 AM

04-05-2016, 08:44 AM

|

#76

|

|

Thinks s/he gets paid by the post

Join Date: Sep 2006

Posts: 2,844

|

TLT has outperformed BRK since Oct 2008

|

|

|

04-07-2016, 04:41 PM

04-07-2016, 04:41 PM

|

#77

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Mar 2005

Location: Chicago

Posts: 13,186

|

Quote: Quote:

Originally Posted by NW-Bound

Yes, one should be sure to include dividends when comparing stocks.

According to Morningstar, a $10K invested 5 years ago would grow to $17,130 in VFINX (Vanguard flagship S&P MF), and $17,253 in BRK. So they run neck-to-neck the last 5 years.

|

Yes. To clear up any confusion (particularly what things "look like" to G4G ) I grabbed this chart from Schwab. Orange = S&P 500 with divs reinvested. Blue = BRK/B. Y axis = growth of $10k. Data as of 01April16. As you said, it appears BRK/B ran neck and neck with the S&P 500 the past five years.

Thanks for the additional info. Yes, Warren has quite the historical record.

Total Return BRK/B

- 1 Year

-1.4%

- 3 Year

+36.1%

- 5 Year

+72.8%

Quote: Quote:

The Total Return is the rate of return representing the price appreciation of a stock with cash dividends reinvested on the ex-date for the most recent 1, 3 and 5 fiscal years.

This growth of $10,000 graph represents the growth of a hypothetical investment of $10,000. It assumes reinvestment of dividends on ex-date.

|

__________________

"I wasn't born blue blood. I was born blue-collar." John Wort Hannam

|

|

|

04-07-2016, 04:51 PM

04-07-2016, 04:51 PM

|

#78

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Mar 2005

Location: Chicago

Posts: 13,186

|

Quote: Quote:

Originally Posted by Gone4Good

That chart doesn't look like it includes dividends. And that's a huge illusory advantage for non-dividend paying companies like Berkshire.

Total returns for Vanguard's 500 Index are 73% over the last five years instead of about 50% shown in the chart. BRK looks like it's up about 60% over 5 years, so trailing the S&P 500 total return. |

Good catch. Indeed the "Thumbcharts" chart does not include reinvested divs for the S&P500. My bad.

It looks like Thumbcharts did get the BRK/B line OK though. You eyeballed it at about 60% but when I literally held a scale to my computer screen, it does look more like 70%. And it turns out the 5 yr return as of April 1st was 72.8%.

__________________

"I wasn't born blue blood. I was born blue-collar." John Wort Hannam

|

|

|

04-07-2016, 05:56 PM

04-07-2016, 05:56 PM

|

#79

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jul 2008

Posts: 35,712

|

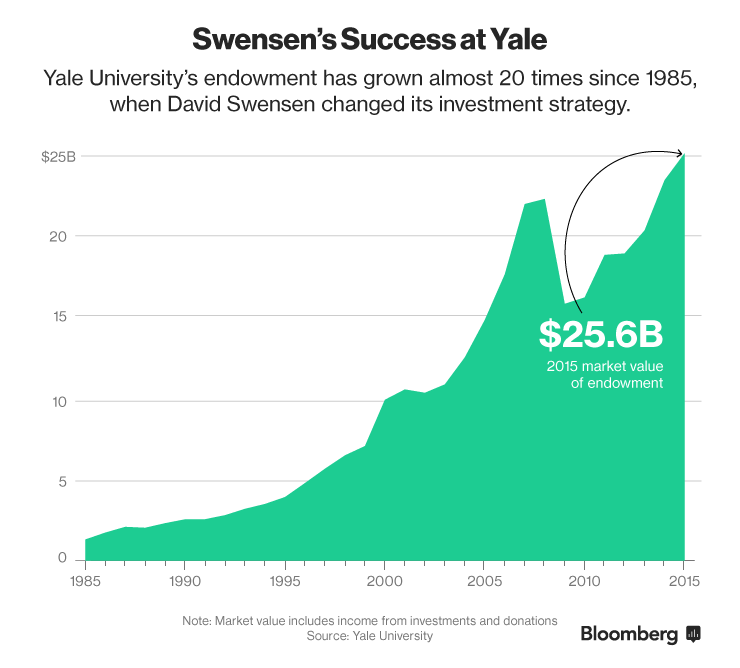

I just saw an article about the performance of Yale endowment fund. See chart below.

Not all the growth came from investment returns, as it includes new donations. However, I doubt that the fresh money amounts to much in later years when the fund got so large.

Look how little the fund dropped during the recession of 2002-2003 and the Great Recession of 2008-2009, compared to the S&P. However, it has not grown as strong in the last few years.

__________________

"Old age is the most unexpected of all things that happen to a man" -- Leon Trotsky (1879-1940)

"Those Who Can Make You Believe Absurdities Can Make You Commit Atrocities" - Voltaire (1694-1778)

|

|

|

04-08-2016, 05:04 AM

04-08-2016, 05:04 AM

|

#80

|

|

Full time employment: Posting here.

Join Date: Apr 2016

Location: warren

Posts: 935

|

I posted this on another thread, but active fund managers are handicapped by the very people who invest in them. I see it all the time at work. When the market goes down, people panic and shift out of stocks. When the market skyrockets, they go all in. They're basically forcing the managers to sell low and buy high.

|

|

|

|

|

|

Currently Active Users Viewing This Thread: 1 (0 members and 1 guests)

|

|

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

|

» Recent Threads

» Recent Threads

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

» Quick Links

» Quick Links

|

|

|