Boho

Thinks s/he gets paid by the post

- Joined

- Feb 7, 2017

- Messages

- 1,844

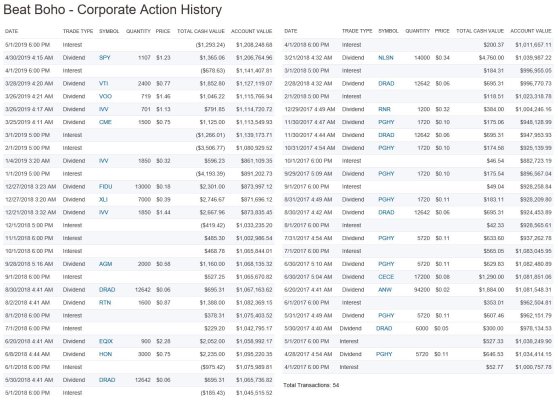

If you really want to let us know how you're doing, it's well within your power. Just post screen shots of your corporate action history. As far as I know, all of the interest charges are posted there - they just haven't been subtracted from your portfolio value.

Here: