Intend to pick this thread up every so often in the coming years for myself and others to enjoy, so best to start afresh. I posted bits and pieces already around the forum earlier.

After reading the Little Book That Beats the Market and several other books, thinking a.o. about the soundness of the approach (vs. the off-putting name of "magic formula" ..) and checking up on Greenblatt and doing some desktop analysis, I decided to launch an experiment with real money: my own.

For those who don't know: The approach is basically selecting value companies with high returns on capital.

I started in february this year (2014) as follows:

After reading the Little Book That Beats the Market and several other books, thinking a.o. about the soundness of the approach (vs. the off-putting name of "magic formula" ..) and checking up on Greenblatt and doing some desktop analysis, I decided to launch an experiment with real money: my own.

For those who don't know: The approach is basically selecting value companies with high returns on capital.

I started in february this year (2014) as follows:

- Ran the on-line screener for 50 companies larger than 300M market cap

- Selected 10 stocks from the 20 with the smallest market cap that I liked the most. This after reading their annual reports and doing some basic research. I put the 20 companies in three buckets ("1", "2", "3" and "out"). The way it worked out I took the full "1" bucket and a few "2" companies.

- In each of those 10, I put about 2.500 euro (+/- 3.2k USD at the time) in. So that's 32k USD at stake (4% of my NW).

- Then, I waited ..

- S&P 500 gained about 13%

- The entire 50 company list gained about 13% too

- The smallest 20 companies gained about 17%

- My selection gained about 4% (oops)

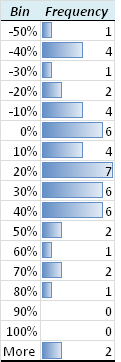

- There is a huge spread in returns between individual companies within the list. I'll post a histogram later on.

- Given that, 10 stocks is not nearly enough to diversify. The book mentions this, now I understand better why.

- The seven companies I liked the most (with a "1") had a 19% return in aggregate. That went well.

- The 3 companies I took from the "2" bucket ruined my performance. Two them tanked with 47%.

- The 10 companies I didn't select had wildly varying returns. e.g. two of them more than doubled, one halved.

Last edited:

and those that still live

and those that still live