I hadn't dug below the headlines before I saw eroscott's post, but I knew the Tesla news was bad as he resorts to the usual 'deflect' with "but... China!" and "but... 2020!" and "but... New Factories!" . And then Ready with "but... Model Y!".

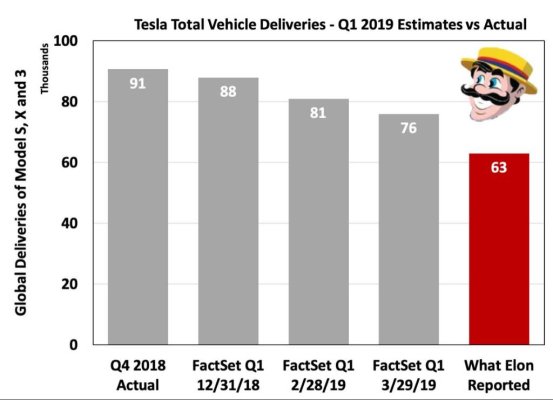

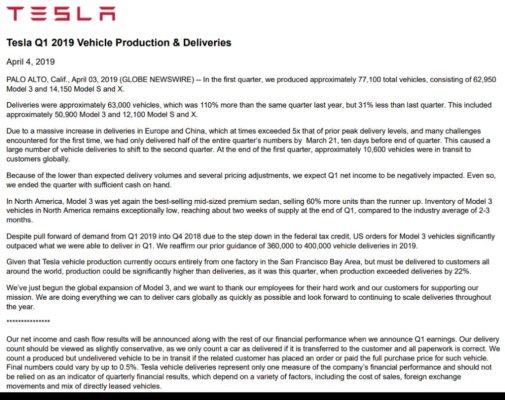

I'll skip the delivery disappointment for now, and focus on production. I think production is where the really bad news is. Hiccups in deliveries to new markets might be expected, but why were production numbers so low? Q1-2019, 77,100 vehicles produced, when Q4-2018 production was 86,555 vehicles? How do you call a 10% drop "growth"? How is this the "exponential growth" that has been talked about by the fans (OK, a negative exponent?)?

Before this gets blamed on the delays in shipping to new markets, let's think about that. Why not shift sales to the US when these delays are being seen?

Well, Occam says it is because US demand is just not there. There have been other signs, all deflected by fan exclamations of "EU!", "China!","new factories!".

Back to deliveries - I said that hiccups in deliveries to new markets might be expected. So what does this say about Tesla? They didn't anticipate these hiccups? Why the heck wouldn't you start out with small shipments to the new markets, work out any kinks, then ramp up as things get worked out? Again, Occam says it is because US demand is just not there. It also points to some incompetence of the Tesla leaders for making these Q1 delivery predictions without accounting for the risks in starting up a new market. What else have they failed to anticipate? Is this really what a company with a solid future looks like?

-ERD50