Moneygrubber

Recycles dryer sheets

- Joined

- Oct 16, 2011

- Messages

- 156

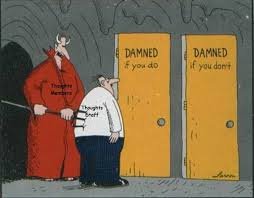

Whats your prediction for no raise or a fed raise this week and market reaction? I think we get a 1/4 point raise and a big relief rally. What do you think?

Sent from my iPad using Early Retirement Forum

Sent from my iPad using Early Retirement Forum