|

|

06-26-2017, 10:33 AM

06-26-2017, 10:33 AM

|

#1

|

|

Recycles dryer sheets

Join Date: Jul 2016

Location: North East

Posts: 238

|

Trading Mutual Funds

Since I am retired, and I want to be more careful with my investments, most of my portfolio is now in mutual funds as opposed to individual stocks.

One of the big problems with trading funds is that you have to say buy or sell today, before you know the closing price of what you are buying or selling.

I just found a research page on Fidelity that can give me a hint as to what some of the funds “might” do today:

https://eresearch.fidelity.com/erese.../landing.jhtml

The top of the page tells me a little about the overall indexes and foreign markets. The right side tells me about the various market sectors.

I heard good things about China over the weekend. Should I buy a China fund today? Knowing that the US market are relatively flat and that the China market is up over 1% today might affect my decision on buying that fund today. Is this the start of something great? Is it overpriced now? We all have to make our own decisions, it’s just nice to get more information before making that decision.

So, finally, the real reason for this post! Does anyone know of any better sources of information on the “possible” change in price of a mutual fund after the market close?

|

|

|

|

Join the #1 Early Retirement and Financial Independence Forum Today - It's Totally Free!

Are you planning to be financially independent as early as possible so you can live life on your own terms? Discuss successful investing strategies, asset allocation models, tax strategies and other related topics in our online forum community. Our members range from young folks just starting their journey to financial independence, military retirees and even multimillionaires. No matter where you fit in you'll find that Early-Retirement.org is a great community to join. Best of all it's totally FREE!

You are currently viewing our boards as a guest so you have limited access to our community. Please take the time to register and you will gain a lot of great new features including; the ability to participate in discussions, network with our members, see fewer ads, upload photographs, create a retirement blog, send private messages and so much, much more!

|

06-26-2017, 10:40 AM

06-26-2017, 10:40 AM

|

#2

|

|

Thinks s/he gets paid by the post

Join Date: Mar 2017

Location: New York City

Posts: 2,838

|

I know this lady thats trying to remove a "Hex" from my friend. For a few hundred she might know. If he ever sees me again to repay me the Thousand he owes me ill ask him. Other than that, im interested in the answer to your question as well.

__________________

Withdrawal Rate currently zero, Pension 137 % of our spending, Wasted 5 years of my prime working extra for a safe withdrawal rate. I can live like a King for a year, or a Prince for the rest of my life. I will stay on topic, I will stay on topic, I will stay on topic

|

|

|

06-26-2017, 10:44 AM

06-26-2017, 10:44 AM

|

#3

|

|

Moderator

Join Date: Feb 2010

Location: Flyover country

Posts: 25,357

|

Quote: Quote:

Originally Posted by Sandy & Shirley

Since I am retired, and I want to be more careful with my investments, most of my portfolio is now in mutual funds as opposed to individual stocks.

|

Seems to me this might be the answer. Sell your mutual funds and get back into stocks. That way all the uncertainty about your selling price is removed.

__________________

I thought growing old would take longer.

|

|

|

06-26-2017, 10:47 AM

06-26-2017, 10:47 AM

|

#4

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jun 2008

Posts: 13,147

|

I think worrying about what a fund might do in a day sounds a bit like market timing or day trading. Instead, work on a target allocation and reallocation to those allocations.

Of course, there are also ETTs for folks who like the day to day changes. For me, I'm happy to take a step back and reallocate according to my schedule.

__________________

Have you ever seen a headstone with these words

"If only I had spent more time at work" ... from "Busy Man" sung by Billy Ray Cyrus

|

|

|

06-26-2017, 10:52 AM

06-26-2017, 10:52 AM

|

#5

|

|

Thinks s/he gets paid by the post

Join Date: Mar 2014

Location: Southern Cal

Posts: 4,032

|

Some funds from Vanguard will lock you out for 30 days after you sell it. This is why I trade ETFs.

__________________

Just another day in paradise

|

|

|

06-26-2017, 11:21 AM

06-26-2017, 11:21 AM

|

#6

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Sep 2005

Location: Northern IL

Posts: 26,892

|

Quote: Quote:

Originally Posted by easysurfer

i think worrying about what a fund might do in a day sounds a bit like market timing or day trading. Instead, work on a target allocation and reallocation to those allocations.

Of course, there are also etts for folks who like the day to day changes. For me, i'm happy to take a step back and reallocate according to my schedule.

|

+1

-erd50

|

|

|

06-26-2017, 11:21 AM

06-26-2017, 11:21 AM

|

#7

|

|

Recycles dryer sheets

Join Date: Jul 2016

Location: North East

Posts: 238

|

All of this is true, but I do not buy and sell funds on a daily basis. 9 years ago when I had the income from a full time job to fall back on I traded short term covered calls and looked at the market multiple times a day, often changing my positions. I also moved the money in my 401K around in the 10 or so funds that they offered. I no longer have a job’s income to rely on, so I’m more conservative.

I usually hold a fund for 6 months or more, I’ve owned some of them for 5 years and longer, but I am diversified in the sectors that I invest in and do make a few changes every couple of months. I would prefer to give the sell order on a day when I expect the fund price to be at least stable if not going up. I definitely do not want to trade on a bad day if I can avoid it. That is why I am looking for some reasonable expectations on the overall sectors in which I am considering a buy or sell order.

To exaggerate what I said in the first post, if I heard good news about China over the weekend and I see that China is up 10% so far today, is this a good time to jump in? Is this over compensation on the news? Should I wait for a correction?

I made very nice profits doing Roth Conversions last June when Britain dropped out of the EU. The market crashed for two days and I was able to do a large number of conversions at the lower prices, less taxes for moving the same number of shares. $10,000 of ABC dropped to $8,000. I converted it and paid taxes on $8,000. It recovered and grew to $11,000 by the end of the year. So, I basically converted $11,000 of my TIRA to Roth and only paid the taxes on $8,000 of it.

It does not make any difference how you do your personal trading. You can always make better decisions if you have more information. Better information is what I am looking for. How I or anyone else uses that information is up to the individual.

|

|

|

06-26-2017, 11:39 AM

06-26-2017, 11:39 AM

|

#8

|

|

Moderator

Join Date: Oct 2010

Posts: 10,725

|

Depending on the fund's goals, you could probably get pretty close by looking at the index it uses to track itself.

If I were trying to do what you're wanting to do, I'd pull the prospectus PDF for the fund in question, get the index it measures itself against (comparative index), then put both into yahoo finance and get a graph. If you like how it matches, you can use the up-to-the-minute index price as a proxy for what the price of your once-a-day traded mutual fund has done during the trading day. Easier yet, you also could look at the price of the equivalent ETF of your mutual fund, but not all mutual funds have that.

Oh, and while you have the prospectus open, you can check the frequent trading limitations.

|

|

|

06-26-2017, 12:02 PM

06-26-2017, 12:02 PM

|

#9

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jun 2008

Posts: 13,147

|

Quote: Quote:

Originally Posted by Sandy & Shirley

.....

To exaggerate what I said in the first post, if I heard good news about China over the weekend and I see that China is up 10% so far today, is this a good time to jump in? Is this over compensation on the news? Should I wait for a correction?

....

|

IMO, yes, over compensation and over simplification.

Take US Stocks, for example. So much uncertainty for many many month, yet the trend of stocks is up up. At last for now  .

When the correction happens, oh it will happen, is still anyone's guess.

__________________

Have you ever seen a headstone with these words

"If only I had spent more time at work" ... from "Busy Man" sung by Billy Ray Cyrus

|

|

|

06-26-2017, 01:37 PM

06-26-2017, 01:37 PM

|

#10

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Mar 2017

Location: City

Posts: 10,351

|

I am maybe a slow learner. It took me over 25 years to learn two things:

- Nobody in the investment business or anywhere else has the slightest idea what's going to happen in the future.

- The more I play with my food, the less food I end up with.

My wife and I look at our (passive investments) AA once a year while we're at our lake place between Christmas and New Year. Every 1-3 years we make a trade or two. I have never worried in the slightest whether the trade was executed on the day I placed the order or on the next day.

YMMV

|

|

|

06-26-2017, 01:40 PM

06-26-2017, 01:40 PM

|

#11

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: May 2013

Location: ATL --> Flyover Country

Posts: 6,649

|

Quote: Quote:

Originally Posted by braumeister

Seems to me this might be the answer. Sell your mutual funds and get back into stocks. That way all the uncertainty about your selling price is removed.

|

This. I am not sure why you would want to "daytrade" a MF, anyway.

__________________

FIRE'd in 2014 @ 40 Years Old

Professional Retiree

|

|

|

06-26-2017, 01:58 PM

06-26-2017, 01:58 PM

|

#12

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jun 2005

Posts: 10,252

|

There is no point in trading mutual funds when exchange-trade funds are available to do the same thing only much, much better.

As for China, I can't say anything about that, but there are certainly ETFs that let buy Chinese stocks intraday.

If you do start trading with ETFs, please post your trades so that we can follow along. Thanks!

|

|

|

06-26-2017, 01:59 PM

06-26-2017, 01:59 PM

|

#13

|

|

Thinks s/he gets paid by the post

Join Date: Jul 2005

Posts: 4,366

|

I used triggers to rebalance, which required some guessing of end of day mutual fund pricing if I wanted to act immediately.

I used the prices of similar ETF's to guess the direction and rough magnitude of my fund price changes. That was adequate for a long-term investor. I used a little extra margin if I had to make sure I wasn't selling for a loss.

Of course investing in an ETF in the first place would eliminate this problem and the selling restrictions of mutual funds. Although the commission free ETF's can still have selling restrictions.

|

|

|

06-26-2017, 02:26 PM

06-26-2017, 02:26 PM

|

#14

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jun 2005

Posts: 10,252

|

Quote: Quote:

Originally Posted by Animorph

Although the commission free ETF's can still have selling restrictions.

|

That's true, but I will say that if one has to sell within the restricted time period, then one can sell and pay a commission.

|

|

|

06-26-2017, 02:28 PM

06-26-2017, 02:28 PM

|

#15

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Mar 2011

Posts: 8,419

|

Quote: Quote:

Originally Posted by sengsational

Depending on the fund's goals, you could probably get pretty close by looking at the index it uses to track itself.

If I were trying to do what you're wanting to do, I'd pull the prospectus PDF for the fund in question, get the index it measures itself against (comparative index), then put both into yahoo finance and get a graph.

|

+1. Also in my experience, unless there's some catastrophic event taking place, MF prices don't jump around day-to-day all that much.

At worst, tonight's closing price should be within a few bucks of yesterday's.

Or...see "market timing"

__________________

Living well is the best revenge!

Retired @ 52 in 2005

|

|

|

06-26-2017, 04:08 PM

06-26-2017, 04:08 PM

|

#16

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: May 2006

Location: west coast, hi there!

Posts: 8,809

|

Quote: Quote:

Originally Posted by Sandy & Shirley

....

So, finally, the real reason for this post! Does anyone know of any better sources of information on the “possible” change in price of a mutual fund after the market close?

|

I don't know if this helps you or not. Below is my situation for getting a handle on whether to trade funds based on pricing of etf's before the close.

My data sometimes tells me to trade from a US based fund to an international fund at the end of the month. Let's say this is between the SP500 (VFIAX) and the international fund (VFWAX). Now do I do this trade at the end of the month or the next day of the new month? I feel more comfortable making the trade exactly on the end of the month but some analysis seems to indicate that there is not too much difference (on average) as to which day this is done on. I want to be completely mechanical about this decision. If we are too close to the switch criteria I will have to wait to see the actual monthly closing prices.

My solution is to look at the nearness to the fund switch criteria on the next to last trade day of the month. Let's say that that is +1% in favor of switching. Then I will look at the corresponding etf's for these funds: spy and veu. Assuming I am home and not traveling, then around an hour before the close on the last day of the month I will look at these etf's. If they do not give up much of that 1% differential, I will put in the mutual fund switch orders. Otherwise I'll just wait for the true end of day fund prices and place the order for the close on the next trade day.

There is a fair amount of discrepancy between daily etf % changes and corresponding fund % changes for Vanguard funds. That is easy to look at based on Yahoo historical daily data. Overall veu tracks VFWAX pretty well but day to day can be another thing.

One might think that the trading should just be done in etf's. That can have its own complications maybe more so for foreign versus domestic. Having to sell and then quickly turn around and buy another etf with the proceeds depends on the markets not have a big burp between these trades.

|

|

|

06-26-2017, 04:26 PM

06-26-2017, 04:26 PM

|

#17

|

|

Thinks s/he gets paid by the post

Join Date: May 2014

Posts: 1,390

|

Trying to find a price for a mutual fund before the closing day is pretty much impossible. ETF's are good for trading during the day because it is traded throughout the day and the price is available. Some mutual fund companies frown on excessive trading and usually have rules against it during a 3 month period. Brokerages may be more flexible.

__________________

Understanding both the power of compound interest and the difficulty of getting it is the heart and soul of understanding a lot of things. Charlie Munger

The first rule of compounding: Never interupt it unnecessarily. Charlie Munger

|

|

|

06-27-2017, 02:19 PM

06-27-2017, 02:19 PM

|

#18

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Apr 2013

Posts: 11,078

|

Wrong vehicle. Use ETFS or stocks if that's the desire.

|

|

|

09-13-2017, 08:36 AM

09-13-2017, 08:36 AM

|

#19

|

|

Recycles dryer sheets

Join Date: Jul 2016

Location: North East

Posts: 238

|

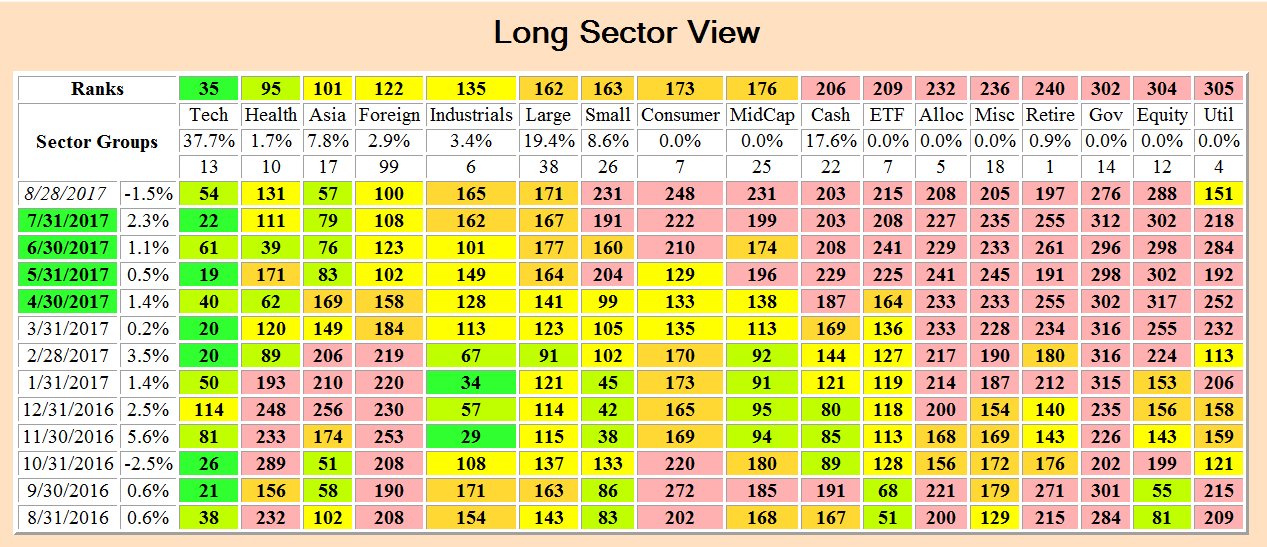

First of all, I do not “day trade” mutual funds, I look at them on a monthly basis and rebalance my portfolios two or three times a year.

I hope this is not against the forum rules, but this is the type of performance information I use to follow the market trends for mutual funds.

I combine the actual “Market Sectors” for each fund I follow into shorter Group Names and track my total investment percentages in each group on a monthly basis. The 17.6% of my holdings in “Cash” are in DNP and RVT, Select Income Dividend funds which provide a steady ROR of about 7.5% in both up and down markets!

I am not tracking any Bonds because we moved about 30% of our investments into guaranteed annual annuities a few years ago.

|

|

|

09-14-2017, 12:04 AM

09-14-2017, 12:04 AM

|

#20

|

|

Recycles dryer sheets

Join Date: Jul 2017

Location: Seattle

Posts: 81

|

Quote: Quote:

Originally Posted by Sandy & Shirley

Since I am retired, and I want to be more careful with my investments, most of my portfolio is now in mutual funds as opposed to individual stocks.

One of the big problems with trading funds is that you have to say buy or sell today, before you know the closing price of what you are buying or selling.

I just found a research page on Fidelity that can give me a hint as to what some of the funds “might” do today:

https://eresearch.fidelity.com/erese.../landing.jhtml

The top of the page tells me a little about the overall indexes and foreign markets. The right side tells me about the various market sectors.

I heard good things about China over the weekend. Should I buy a China fund today? Knowing that the US market are relatively flat and that the China market is up over 1% today might affect my decision on buying that fund today. Is this the start of something great? Is it overpriced now? We all have to make our own decisions, it’s just nice to get more information before making that decision.

So, finally, the real reason for this post! Does anyone know of any better sources of information on the “possible” change in price of a mutual fund after the market close? |

Why not just wait until 330pm EST and then decide ? How much is it really going to change in before 4pm ?

ETFs aren't a free lunch either as you have the spread to deal with and the ETF price may also not be at the true NAV of the fund also

Understanding Premiums And Discounts | ETF.com

And as others have said, mutuals are not really designed for day trading so maybe a different approach ?

|

|

|

|

|

|

Currently Active Users Viewing This Thread: 1 (0 members and 1 guests)

|

|

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

|

» Recent Threads

» Recent Threads

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

» Quick Links

» Quick Links

|

|

|