Hi. I may be interested in buying some shares of the Vanguard emerging-markets mutual fund known as VEIEX.

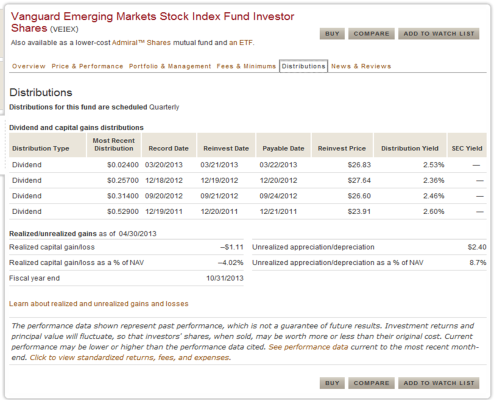

I checked the Vanguard website, and the website says that this mutual fund has never paid a dividend.

Is that a misprint? Or does VEIEX, indeed, not pay any dividends?

Thanks for any information.

I checked the Vanguard website, and the website says that this mutual fund has never paid a dividend.

Is that a misprint? Or does VEIEX, indeed, not pay any dividends?

Thanks for any information.