Seeking any advise on market timing to increase my allocation of stocks (index funds).

I'm a conservative investor -currently abt 85% stable value & bonds and 15% stocks (VHDYX and extended market fund) but want to increase the allotment of stocks. I don't need this for monthly expenses as I'm still working, but would like to see some more growth. I get nervous above a 30/70 allocation, but would be comfortable between 15-30% stock allocation.

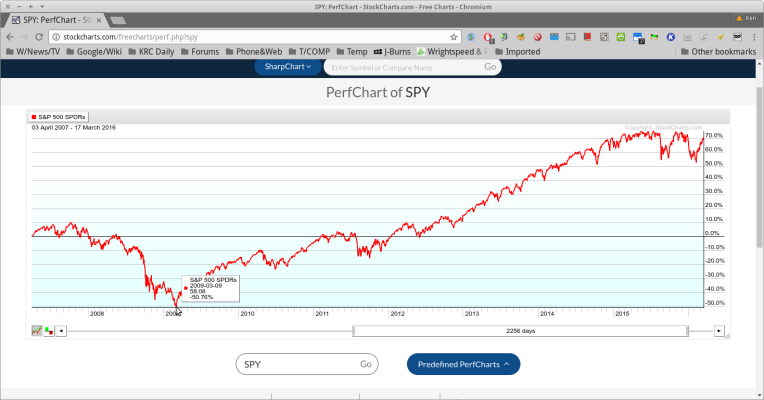

I have 35-40k that I'm comfortable moving, so should I wait for a down day in the market to make the change, move a % at a time, just do it all at once, or just continue to sit on the sidelines for a while ?

?

Any thoughts?

I'm a conservative investor -currently abt 85% stable value & bonds and 15% stocks (VHDYX and extended market fund) but want to increase the allotment of stocks. I don't need this for monthly expenses as I'm still working, but would like to see some more growth. I get nervous above a 30/70 allocation, but would be comfortable between 15-30% stock allocation.

I have 35-40k that I'm comfortable moving, so should I wait for a down day in the market to make the change, move a % at a time, just do it all at once, or just continue to sit on the sidelines for a while

Any thoughts?