OrcasIslandBound

Recycles dryer sheets

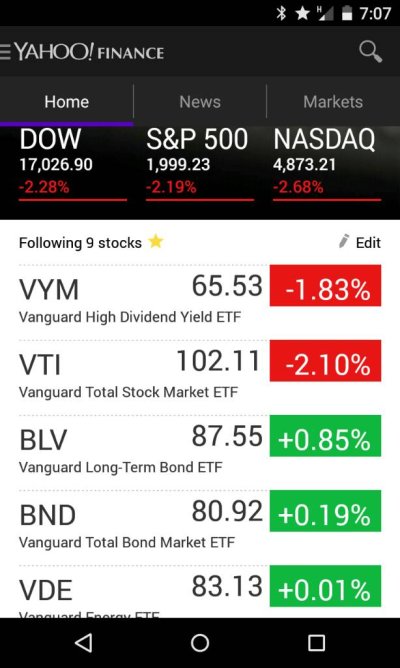

Today is turning into a microcosm of why I like to have a chunk of long term bonds in my portfolio. Notice BLV moving opposite the stock market direction. See the picture.

Sent from my Nexus 4 using Early Retirement Forum mobile app

Sent from my Nexus 4 using Early Retirement Forum mobile app