|

|

09-04-2016, 07:34 PM

09-04-2016, 07:34 PM

|

#21

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: May 2005

Posts: 17,241

|

I think we are getting a bit far afield from the Apple tax issue... but hey, I might as well do it also...

I think it silly that the US and Japan are talking about the negatives of Brexit... it is not like everybody is going to stop trading with one of the larger economies out there... I do not see the EU saying 'screw you' and not allow the UK to trade... they will more than likely get similar (or at least close) to the same terms as the US or Japan... not free flow of workers etc., but easy enough to get things done...

As for Apple, there are enough stories out there that says the US taxpayer will pay it since they will get a foreign tax credit... but, I bet there are other things involved that these articles are missing... or there is no benefit to being in Ireland in the first place...

|

|

|

|

Join the #1 Early Retirement and Financial Independence Forum Today - It's Totally Free!

Are you planning to be financially independent as early as possible so you can live life on your own terms? Discuss successful investing strategies, asset allocation models, tax strategies and other related topics in our online forum community. Our members range from young folks just starting their journey to financial independence, military retirees and even multimillionaires. No matter where you fit in you'll find that Early-Retirement.org is a great community to join. Best of all it's totally FREE!

You are currently viewing our boards as a guest so you have limited access to our community. Please take the time to register and you will gain a lot of great new features including; the ability to participate in discussions, network with our members, see fewer ads, upload photographs, create a retirement blog, send private messages and so much, much more!

|

09-05-2016, 03:53 AM

09-05-2016, 03:53 AM

|

#22

|

|

Thinks s/he gets paid by the post

Join Date: May 2014

Location: Utrecht

Posts: 2,650

|

Quote: Quote:

Originally Posted by Texas Proud

I think it silly that the US and Japan are talking about the negatives of Brexit... it is not like everybody is going to stop trading with one of the larger economies out there... I do not see the EU saying 'screw you' and not allow the UK to trade... they will more than likely get similar (or at least close) to the same terms as the US or Japan... not free flow of workers etc., but easy enough to get things done...

|

Similar to the US and Japan is not enough to avoid major negatives for the UK. It's a.o. about being able to count and operate as a EU country for manufacturing and financial purposes (single EU financial services passport).

If the UK doesn't get that a different country will be chosen as base for European operations.

Japan released a set of "requests" yesterday:

https://www.theguardian.com/world/20...le-to-fanciful

How bad it will be, no idea, and certainly not world ending, but it will hurt.

|

|

|

09-05-2016, 04:58 AM

09-05-2016, 04:58 AM

|

#23

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jul 2008

Posts: 35,712

|

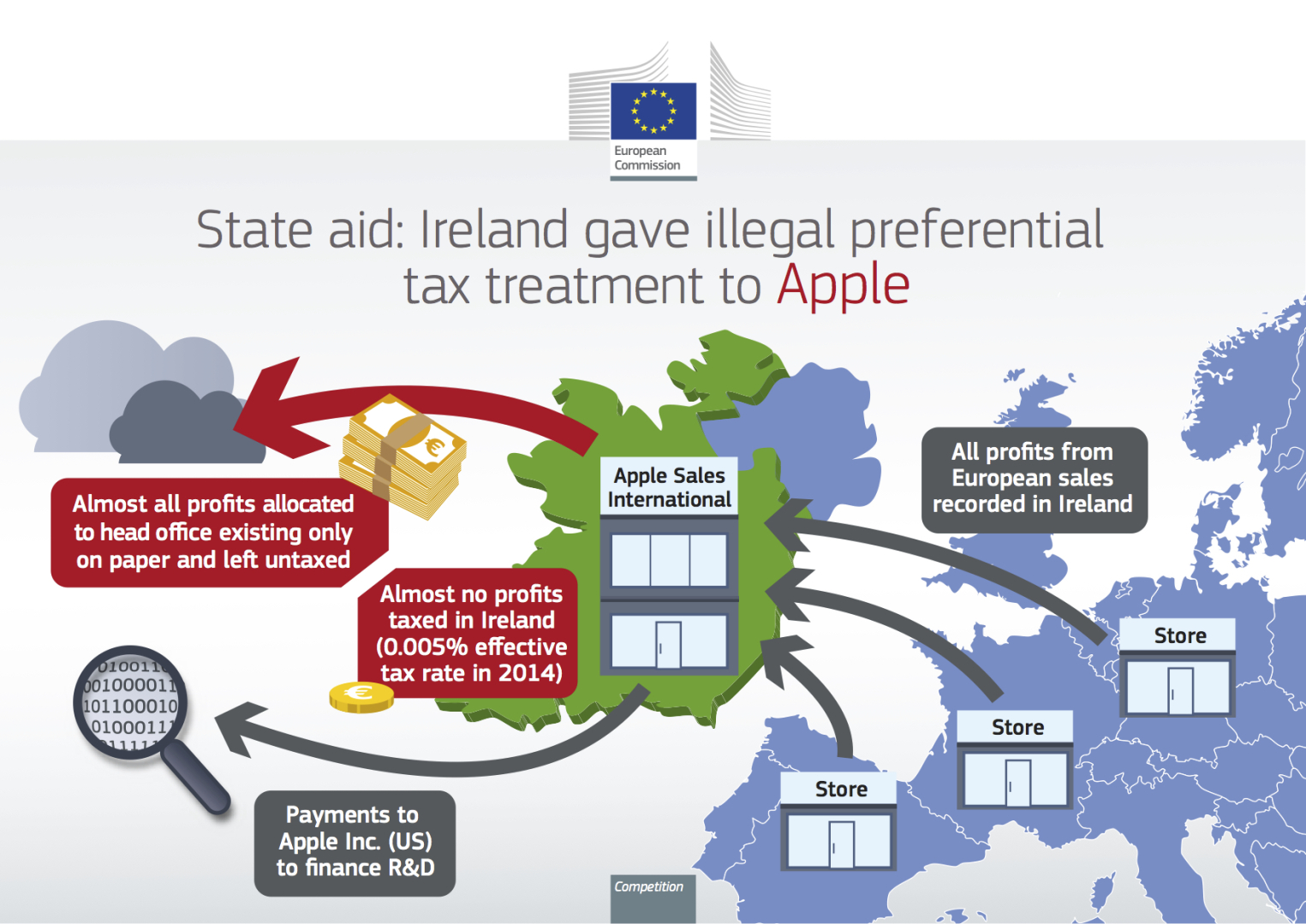

Exactly what taxes was Apple accused of evading? The only thing I have found is on a Bloomberg article, which says Apple booked all profits from EU sales to an Ireland phantom headquarter, which is then levied a tax rate of 0.005%.

The following graphics was released by the EU commission, then republished in Bloomberg article.

See: http://www.bloomberg.com/news/articl...u-need-to-know.

__________________

"Old age is the most unexpected of all things that happen to a man" -- Leon Trotsky (1879-1940)

"Those Who Can Make You Believe Absurdities Can Make You Commit Atrocities" - Voltaire (1694-1778)

|

|

|

09-05-2016, 06:23 AM

09-05-2016, 06:23 AM

|

#24

|

|

Thinks s/he gets paid by the post

Join Date: May 2014

Location: Utrecht

Posts: 2,650

|

Quote: Quote:

Originally Posted by NW-Bound

Exactly what taxes was Apple accused of evading? The only thing I have found is on a Bloomberg article, which says Apple booked all profits from EU sales to an Ireland phantom headquarter, which is then levied a tax rate of 0.005%.

|

The way I understand is that Apple didn't evade anything. Ireland wasn't allowed to offer the 0.005% tax rate since it didn't apply the rate to all companies.

So Ireland was in the wrong, not Apple. As a consequence they have to apply the correct tax rate. Illegal contracts cannot be enforced. So Apple's deal is null and void, and they have to pay the 'normal' rate.

|

|

|

09-05-2016, 07:02 AM

09-05-2016, 07:02 AM

|

#25

|

|

Recycles dryer sheets

Join Date: May 2011

Posts: 145

|

Quote: Quote:

Originally Posted by Totoro

The way I understand is that Apple didn't evade anything.

|

+1

The terminology is important. The EU commissioner has not accused Apple of evading tax, nor has anyone else. The commissioner has accused Ireland of providing a structure which unfairly allows Apple to avoid tax.

The reading of the opinion is important and may require ignoring how it is reported in the media. Does the EU commissioner order Apple to pay the tax, or does the commissioner order Ireland to collect the tax? Big difference,....especially for Ireland.

|

|

|

09-05-2016, 07:27 AM

09-05-2016, 07:27 AM

|

#26

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jul 2006

Posts: 11,401

|

It's complicated.....

We Need To Talk About Apple: Two top Irish economists go head-to-head over the €13 billion

http://jrnl.ie/2959549

|

|

|

09-05-2016, 11:04 AM

09-05-2016, 11:04 AM

|

#27

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Sep 2012

Location: Seattle

Posts: 6,023

|

Isn't the solution here obvious? Apple should pay Ireland the tax and then sue Ireland in international court for breach of contract and collect back the payment.

|

|

|

09-05-2016, 11:20 AM

09-05-2016, 11:20 AM

|

#28

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jul 2014

Location: Spending the Kids Inheritance and living in Chicago

Posts: 17,094

|

Quote: Quote:

Originally Posted by BeachOrCity

Whats most interesting to me is this "race to the bottom" where various countries (and their "customers": big companies), vie to see who can give the companies the best tax deal. The countries that dont play along lose out.

Since so much of the economy (and cost of goods) these days is based on the 'value' of the intellectual capital within said goods, companies are able to play games with this valuation and pay lower taxes. Example: where is apples intellectual property primarily generated? Answer: california! But somehow they play the tax laws and tax treaties to make it like the profit from all the work being done in california is actually overseas not in the usa. Thus they pay the lower foreign tax rate.

Ultimately it is the individuals, globally, who have to pay for this as by the companies having lower rates necessitates individuals having higher rates.

Sad.

|

It's not just Countries that do this, but Cities and States, each desperately trying to attract a big company. With huge tax reduction incentives or grants.

In some cases, it might make sense if a company comes and has to hire locals.

Other cases, a city gets the company to move 30 miles, like Motorola to Chicago from the suburbs, well most Motorola workers will just commute, so the benefit is pretty hard to see.

|

|

|

09-05-2016, 11:29 AM

09-05-2016, 11:29 AM

|

#29

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: Jul 2008

Posts: 35,712

|

Quote: Quote:

Originally Posted by Totoro

The way I understand is that Apple didn't evade anything. Ireland wasn't allowed to offer the 0.005% tax rate since it didn't apply the rate to all companies...

|

OK, it's a matter of terminology, I guess.

Besides the link provided by Meadh above, I also found an article quoting some US tax experts raising the same question. That is, why does Apple get special tax treatment that is different than what Ireland has on its book? Then, it is an under-the-table deal that is not at all legitimate.

You would not like it, if the owner of a mega mansion down the street from you gets a special real-estate tax deal that you are not offered and kept in the dark about.

One expert explains that Ireland let Apple define what is taxable in Ireland, and what is "stateless". It also appears to me that "stateless" profits will be taxed if and when Apple brings that money back to the US. Hence, some US officials are for Apple in this matter.

If Apple has to pay taxes to one country or another, then it is better to pay it in Ireland I guess, rather than in the US which has a higher tax rate. Or has Apple found a way to not pay to anybody? Can I find a way to not pay tax to anybody, because I am neither here nor there?

I really do not know how corporate taxes work, let alone international taxes. I can barely keep up with tax laws for my own taxes.

__________________

"Old age is the most unexpected of all things that happen to a man" -- Leon Trotsky (1879-1940)

"Those Who Can Make You Believe Absurdities Can Make You Commit Atrocities" - Voltaire (1694-1778)

|

|

|

09-05-2016, 11:58 AM

09-05-2016, 11:58 AM

|

#30

|

|

Recycles dryer sheets

Join Date: Nov 2011

Posts: 185

|

Quote: Quote:

Originally Posted by Totoro

The way I understand is that Apple didn't evade anything. Ireland wasn't allowed to offer the 0.005% tax rate since it didn't apply the rate to all companies.

So Ireland was in the wrong, not Apple. As a consequence they have to apply the correct tax rate. Illegal contracts cannot be enforced. So Apple's deal is null and void, and they have to pay the 'normal' rate.

|

This is the view of the EC, not that of Ireland or Apple. The Irish authorities have said that Apple has simply paid the 12.5% corporate tax rate on all Irish-source income as does every other corporation doing business in Ireland. There was never any 0.005% tax rate offered to Apple and no special deal not available to any other corporation doing business in Ireland. To tax Apple on its income sourced outside of Ireland, as the EC demands, would simply be beyond its statutory taxing authority to do so. Meanwhile, Apple makes clear in its annual 10K filings with the SEC that these foreign profits will be taxable by the U.S. when they are repatriated, in full compliance with U.S. and international tax law. It is doubtful that this EC ruling against Apple will ultimately prevail in court.

|

|

|

09-05-2016, 02:01 PM

09-05-2016, 02:01 PM

|

#31

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: May 2005

Posts: 17,241

|

Quote: Quote:

Originally Posted by NW-Bound

OK, it's a matter of terminology, I guess.

Besides the link provided by Meadh above, I also found an article quoting some US tax experts raising the same question. That is, why does Apple get special tax treatment that is different than what Ireland has on its book? Then, it is an under-the-table deal that is not at all legitimate.

You would not like it, if the owner of a mega mansion down the street from you gets a special real-estate tax deal that you are not offered and kept in the dark about.

One expert explains that Ireland let Apple define what is taxable in Ireland, and what is "stateless". It also appears to me that "stateless" profits will be taxed if and when Apple brings that money back to the US. Hence, some US officials are for Apple in this matter.

If Apple has to pay taxes to one country or another, then it is better to pay it in Ireland I guess, rather than in the US which has a higher tax rate. Or has Apple found a way to not pay to anybody? Can I find a way to not pay tax to anybody, because I am neither here nor there?

I really do not know how corporate taxes work, let alone international taxes. I can barely keep up with tax laws for my own taxes.

|

Just to let you know, the US tax code has many things that were written for one or a few companies or individuals...

Back in the 80s where I was doing estate taxes one of the estate lawyers was giving class on tax planning... he had found some strange language about either gift or estate taxes (cannot remember).... it said that there was a break for so and so who was born between X and Y dates... and lo and behold.... it was a special thing for the Gallo brothers (you know, the wine makers)... he estimated at the time it saved them $200 mill in taxes...

Now, I guess if you were some mega millionaire who was born between those dates and did so and so, you got the break also, but it was put in specifically for the Gallo family...

This is not the only one out there.... it used to be common from what I remember being told... maybe not as common now, but who really knows when they have 1,000 to 3,000 page legislation....

|

|

|

09-06-2016, 09:01 AM

09-06-2016, 09:01 AM

|

#32

|

|

Thinks s/he gets paid by the post

Join Date: May 2014

Location: Utrecht

Posts: 2,650

|

Nice write-up on the reasoning of the European Commission on their website:

European Commission - PRESS RELEASES - Press release - State aid: Ireland gave illegal tax benefits to Apple worth up to €13 billion

Some nice tidbits (to me):

Quote: Quote:

|

Under the agreed method, most profits were internally allocated away from Ireland to a "head office" within Apple Sales International. This "head office" was not based in any country and did not have any employees or own premises. Its activities consisted solely of occasional board meetings. Only a fraction of the profits of Apple Sales International were allocated to its Irish branch and subject to tax in Ireland. The remaining vast majority of profits were allocated to the "head office", where they remained untaxed.

|

So it's about Ireland have a tailored agreement with Apple to allocate profits to an untaxed entity based on a fictional HQ vs. where profits were 'really made', which according to the EC is equal to (illegal) subsidies.

Quote: Quote:

|

The recovery period stops in 2014, as Apple changed its structure in Ireland as of 2015 and the ruling of 2007 no longer applies.

|

Probably changed structure since they aren't 100% sure it will hold up in court.

Quote: Quote:

|

Finally, all Commission decisions are subject to scrutiny by EU courts. If a Member State decides to appeal a Commission decision, it must still recover the illegal state aid but could, for example, place the recovered amount in an escrow account pending the outcome of the EU court procedures.

|

To be continued ..

|

|

|

09-06-2016, 10:51 AM

09-06-2016, 10:51 AM

|

#33

|

|

Give me a museum and I'll fill it. (Picasso)

Give me a forum ...

Join Date: May 2005

Posts: 17,241

|

This stuff about not having any employees etc. etc. is just smoke to the masses...

This was way back in the 80s... mega had a 'branch' in Bermuda.... since I did the budget I went to the controller of it and asked about it... she said "the office is here in my drawer"... she pulled open a drawer and there it was...

Now, we did have a PO box there and had to pay someone to 'get the mail'... I was told he did it for hundreds of companies...

Why did we have it  Because it gave us tax benefits... there was NO requirement to have a physical building or even employees...

Not saying Apple was or was not playing fast and loose, just that some of the stuff coming out is done by almost all international companies...

|

|

|

|

|

|

Currently Active Users Viewing This Thread: 1 (0 members and 1 guests)

|

|

|

Posting Rules

Posting Rules

|

You may not post new threads

You may not post replies

You may not post attachments

You may not edit your posts

HTML code is Off

|

|

|

|

» Recent Threads

» Recent Threads

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

» Quick Links

» Quick Links

|

|

|