Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I can't imagine not owning our own home, or more directly, homeownership not being more cost effective than renting all (costs) considered. But the economic choice between home ownership and renting is intriguing and worth following to me.

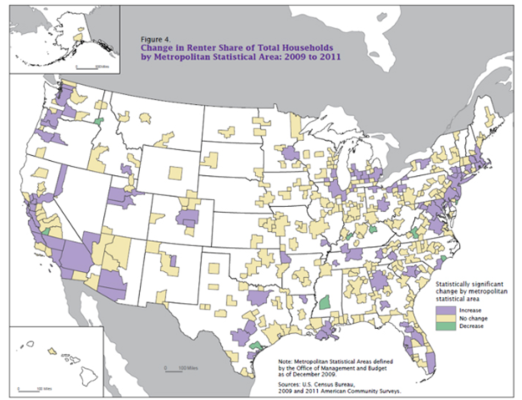

The decline in home ownership appears to stem from working age folks mostly, and understandably (job mobility). And the ever higher cost of buying a home in many MSAs.

Thought it might be to others as well.

Renting the American Dream - Richard Florida - The Atlantic Cities

The decline in home ownership appears to stem from working age folks mostly, and understandably (job mobility). And the ever higher cost of buying a home in many MSAs.

Thought it might be to others as well.

3 in 5 adults believe that "renters can be just as successful as owners at achieving the American Dream.

I am not arguing that America will or should shift from a nation of owners to a nation of renters. My main point is that tilting the home ownership rate back from its high of 70 percent to say 55 or 60 percent — not too far from where the U.S. is at today — would seem to be line in with greater labor market flexibility and economic dynamism.

Renting the American Dream - Richard Florida - The Atlantic Cities

Attachments

Last edited: