Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

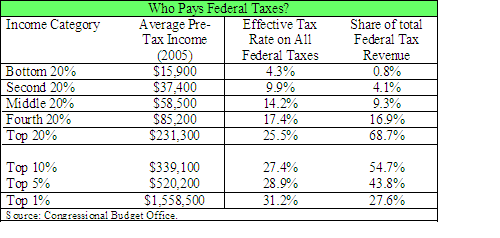

Once again I see members in other threads here broadly proposing we first tax the rich more to solve our federal/state deficit problems. The rich already pay more taxes than most while getting fewer benefits (by design and universally accepted), the days of paying little to no taxes due to tax loopholes ended long ago.

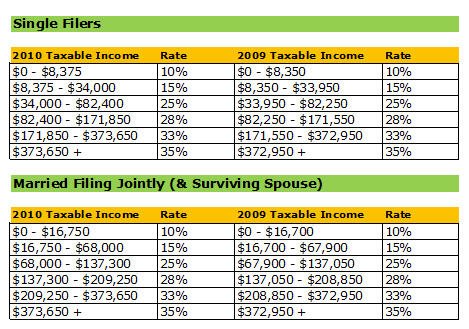

So most here are very good with numbers, just exactly what would YOU propose for marginal rates for the top income level, or as many income levels as you care to modify?

If it's not obvious, while DW and I are nowhere near rich, I don't agree with the rich bashing. If you took 100% from everyone in the top bracket it would hardly make a dent in the deficit. Like some others, I'm afraid we are going to have to share the pain with considerably less spending (meaning fewer services & public benefits) AND considerably higher taxes for everyone.

It will be interesting to watch the reply to viewed ratio on this thread...

So most here are very good with numbers, just exactly what would YOU propose for marginal rates for the top income level, or as many income levels as you care to modify?

If it's not obvious, while DW and I are nowhere near rich, I don't agree with the rich bashing. If you took 100% from everyone in the top bracket it would hardly make a dent in the deficit. Like some others, I'm afraid we are going to have to share the pain with considerably less spending (meaning fewer services & public benefits) AND considerably higher taxes for everyone.

It will be interesting to watch the reply to viewed ratio on this thread...