Some good points, let me take a stab at 'em:

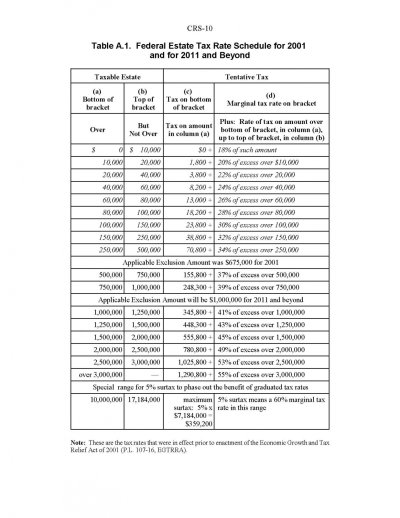

Mostly agree. There is no absolute right, it must be legal and of course we need to pay taxes to support some level of govt. But hitting a pile of money with a 55% (or whatever it is) rate all in one fell swoop just doesn't sit well with me. I'll try to touch on this later.

Okay. I guess my only question is what tax rate would seem acceptable?

Whats the average profit margin of a business (I'll guess 8-10% range?)? I'd bet that 1.8% is a substantial chunk of it, just like we talk of an added 1% expense fee requiring us to have an added 25% in our nest egg for a 4% WR. And maybe what I'm about to say is a small number, but I'll repeat that doesn't make it right - maybe some of these businesses were on the edge. The owner just died, maybe he/she was instrumental in running the business, and this 1.8% for 14 years is the straw on the camel's back?

We probably need Martha here. I guessed that the value of a business was the discounted sum of future profits. If the business is “on the edge” the discounted profits would be below the exempt amount. Same is true if the deceased is the source of the profits (e.g. a dental practice).

But, would you apply the same rule to other taxes? My daughter is a sole proprietor. Her FICA tax is 15.3%. Maybe that’s the difference between the business making financial sense or being just a hobby. Even if it is in her case, I wouldn’t eliminate FICA because some businesses are on the edge.

I don't think too many here think it always turns to zero. But whatever is avoided is avoided. It doesn't change the argument.

I’m not sure what argument doesn’t change. Any tax generates avoidance and evasive actions, that’s not an adequate argument to say we shouldn’t have the tax.

I have no idea what the break out is, obviously it some combination of all of the above. But I do find it offensive to lump them together. Clearly some of those who accumulated wealth did it through hard work, skill, education, vision, etc. And they created useful products and services and created jobs and overall were a real asset to society. Someone else won the lottery and goofed off.

There is no way for the tax code to differentiate "good" money from "bad" money. So let's not lump the good with the bad, they good might even be the majority, I don't know if numbers can capture this. And then we get into the crazy discussions of whether a sports star is "lucky" to be born with the physical attributes to play the game. To me, this lumping of the rich is no less offensive than saying that since poor people have higher rates of committing theft, we should start locking up all poor people.

If we want to make moral judgments on "good" money and "bad" money, I suggest we vote with our wallets and not broad brush tax code. I don't buy products from rappers that I find offensive, (add endless examples).

I didn’t say “good” and “bad”, I said “resulting from work” and “resulting from luck”. I don’t find good luck immoral, I’ve enjoyed some of it myself. Nobody is suggesting that we lock up all rich people.

I don’t care what words you want to put on it. I use “work” and “luck”, if you find them offensive I’ll be happy to change the words. The concept is that (1) some of your financial success results from your decision to work harder than somebody else with the same opportunities, and (2) some comes from having better opportunities. Yes, I’d put genes in 2.

IMO, it’s physically impossible to work much more than twice as hard as the average American over a lifetime. If the average is 42 hours, I think 84 hours is something that’s not sustainable. I expect some people work 65 hours but are unusually intense, and get to “twice” that way. If the average American earns $40k for 40 years that’s $1.6 gross earnings in a lifetime. Maybe $3.2 gross is the upper limit of (1). Deduct for spending and add for typical investment returns and an estate of $3.5 million seems like the top. Anything over that must have come from (2). So the suggested exemption of $3.5 million or $7.0 million seems like the top end of what extra hard work can produce.

But that’s “luck” from the perspective of the deceased. I think it’s clear that from the perspective of the heir, any inheritance is “luck”. That seems more relevant to me.

Damn right they do! And they can buy fancy cars and villas and yachts! That's why so many aspire to be rich! And let's not forget that the vast majority of posters here are "rich" relative to the average US citizen, and "filthy rich" compared to your average third world citizen. I'll go back to my broad-brush defense. We need proper laws and enforcement to prevent/punish wrongdoers. Someone with a lot of money can use it to do damage. A union with a lot of power can do damage. I want the damage stopped, I'm not going to pre-judge the class of people.

I see a fundamental difference between “so much money you can buy a yacht” and “so much money you can buy a congressman”. It may be the same money, but one use is ho-hum while the other seems anti-democracy. I could agree with your “pre-judge” if the issue were putting people in jail. I’m talking about least-destructive taxes.

Money is a resource. Setting a good example, exposing your child to books, music, the arts, sciences are other resources. Good parents try to pass these onto their children. When do we go in and decide that it isn't "fair" for a child to have the advantage of good parents? If I can't give my kids money, maybe I can't give them a good education or experiences either. It isn't "fair". The "fair" police don't want my kids to have anything that everyone doesn't get, whether I worked for it or not. I know that sounds silly, but it really is an extension of what you are saying.

This is a slippery slope argument. I could say we shouldn’t have any taxes on wages because that would lead to 100% taxes on wages, and I'd be wrong. In this case, I see a fundamental difference between trying to give your kids the chance to be productive citizens and giving your kids so much that they can consume without producing.