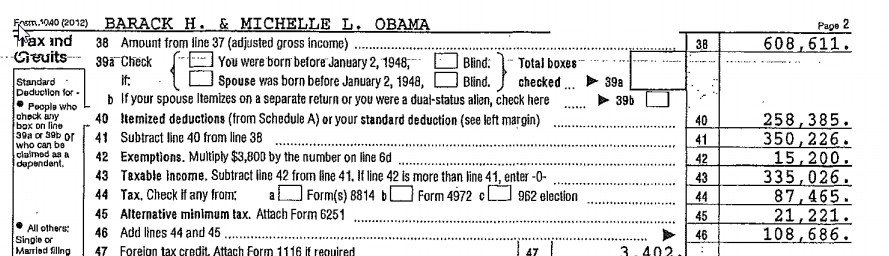

Of course this is exactly the topic we are talking about, retirement account caps. If Obama did this every year for a couple of dozen years he would bit the $3 million cap as well.

Yes, he's clearly not making this decision for his own personal benefit.

And let's face it, he doesn't really need to "live" on his income at the moment.

Nancy Reagan was famously taken aback when a White House usher presented her first bill in 1981, saying, "Nobody ever told us the president and his wife are charged for every meal, as well as incidentals like dry cleaning, toothpaste, and other toiletries." They don't have to pay rent or for the electric, though.

The cap is set at the cost of an annuity that would deliver $205K (2013) to someone 62 years of age (adjusted up or down depending on age). Also stated defined benefit plans come into play in determining the cap. Since the President will receive a defined benefit of greater than the cap, does that mean he can not contribute to an IRA/457b and will have to remove whatever he has already contributed?

Again, I suspect that the "have to remove" stuff isn't real... that the rules once written would simply cut-off further contributions. Regardless, yes, I'm sure that it would apply to the President just like it would apply to anyone else.

While there are rare occasions, when maxing out your 401K isn't the smartest thing to do, for 95% or so of the population, it is.

Yet, with the new rule in place, it is still completely predictable, which is the issue that I was replying to, there.

The benefits of tax deferral while in higher tax bracket, tax deferred compounding, and generally a partial company match, outweigh the negatives of smaller number of investment choices, and often higher fees.

As I said this isn't the right thread to discuss the reasons why you might not max out your 401k. It is worthy to note that, especially for employees of small businesses, 401k match is an endangered species. (I don't get any, and my spouse won't get any because it is a one year contract and the company has two-year vesting for matching - how nice.) We also get really crappy fund choices: I have only one fund with an ER under 1.3%, and that's a S&P 500 Index fund at 0.86% (which most S&P 500 Index funds are around 0.2%).

Why $3 million doesn't this approach mean you will miss out on the free money your company gives you for matching if you hit $3 million long before your retirement age?

The way it reads to me: yes. Definitely.

What if the price of annuities change and the cap increases to $4.5 million? I guess you miss out on all the benefits of tax deferred, company match, because you made your one time decision that once I see $3 million in my account I stop contributing.

Incorrect. You simply restart contributions when you're allowed to. If your company offers you company match, you can take advantage of that. You lucky dog.

Which is my point with the new system it requires you to pay constant attention to your retirement balances, this years cap, and factor in expected returns, company match etc.

You mean it requires careful planning for retirement? How is that any different from today? Answer: It isn't. As someone who's trying to power though yet-even-more complex decisions right now, I can say that I'm not even slightly concerned about what would extra work this new cap would add in: It would be trivial as compared to what people already need to work through.

It is not a one time event. It is also not something that can be done in 3 minutes.

Fair enough: 3 minutes a year. Try figuring out how much you're going to use of your HSA each year in such a short period of time. Or which year you're going to take capital gains from a holding you're planning to sell. And so on... Those are regular events for people who have that much money, that they have to do continually, if they're being conscientious about their financial future.

However I guarantee if anything like the President's proposal comes to pass. This forum and other like we be filled with people asking the question, how much should I contribute to my 401K?

And this forum is a ghost town now? No one has any questions? <shrug>