I think the information in this video is central to ER. Most of us have run firecalc, have analysed our swr, and all of that. The foundation for all those calculations is that the financial picture doesn't stray too far from what we have seen in the past. I have noticed on this and other boards that when someone questions the foundation, it's not a welcome topic. And it is easy to see why...we have all bought into this system, and if it goes too far south, and we go from the good life to something more like the life of those who didn't 'prepare for the future', then we start looking a lot less smart.

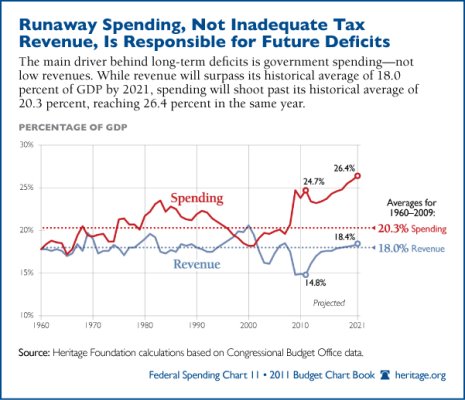

But it's not like we, as investors, have our hands completely tied. It might be hard for those of us that have US assets to avoid the possible future tax tsunami, we don't have to ride the USD down the hill, should that come to pass. So having a heads-up on the fact that the US fiscal house is completely out of whack is important to an ER, imho.

Guns, Gold and 7 years of freeze dryed food.

Guns, Gold and 7 years of freeze dryed food.