Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

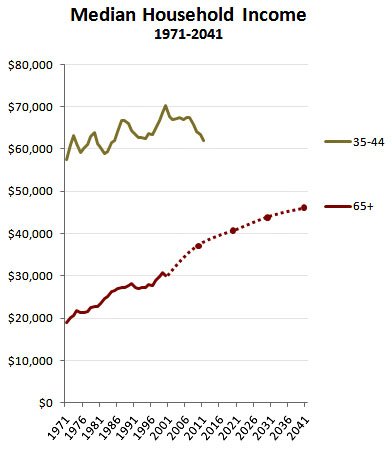

This chart should give pause to BOTH sides of the Soc Sec revenues vs benefits debate (increasing taxes on workers vs slowing the growth of SS benefits). Makes it easy to support or dispute either. Seniors incomes have increased far faster than middle age workers for decades. The author does not project incomes for middle age tax paying workers, but I don't know anyone who is projecting a reversal in the long standing trend for real median incomes (flat).

I still support sacrifice by both sides, a compromise of higher contributions and slowing benefit growth. And that we should be talking about all entitlements, not kidding ourselves by addressing Soc Sec independently.

These things are never simple...

CHART: Will Boomers and Gen Xers Be Able to Retire? | Mother Jones

I still support sacrifice by both sides, a compromise of higher contributions and slowing benefit growth. And that we should be talking about all entitlements, not kidding ourselves by addressing Soc Sec independently.

These things are never simple...

CHART: Will Boomers and Gen Xers Be Able to Retire? | Mother Jones

Attachments

Last edited: