corn18

Thinks s/he gets paid by the post

- Joined

- Aug 30, 2015

- Messages

- 1,890

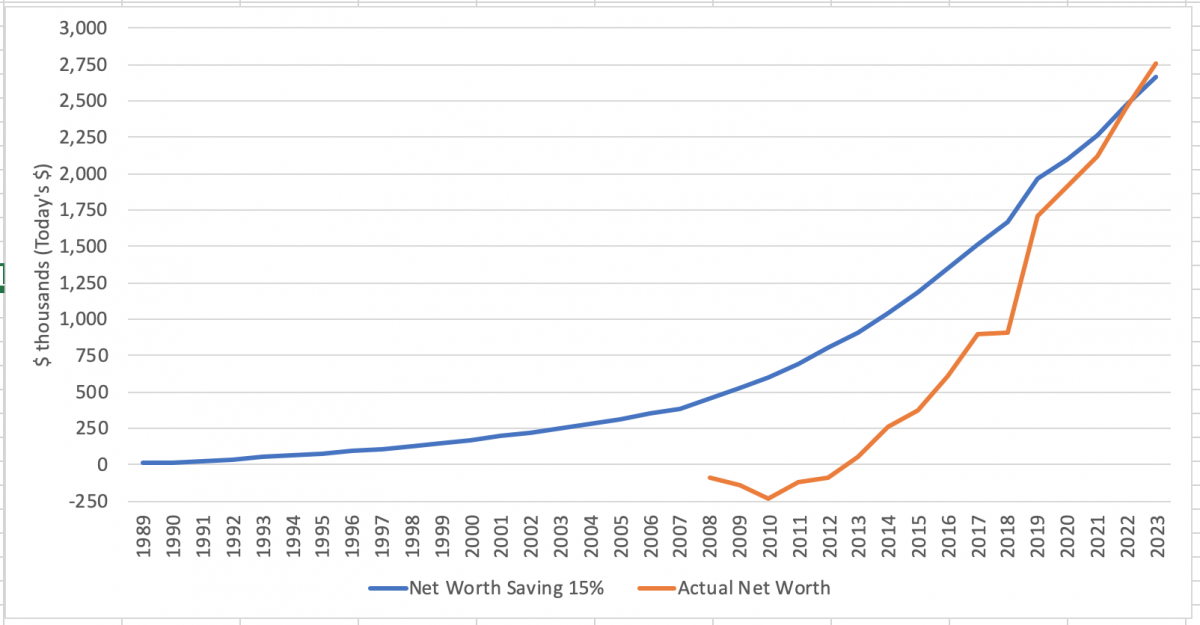

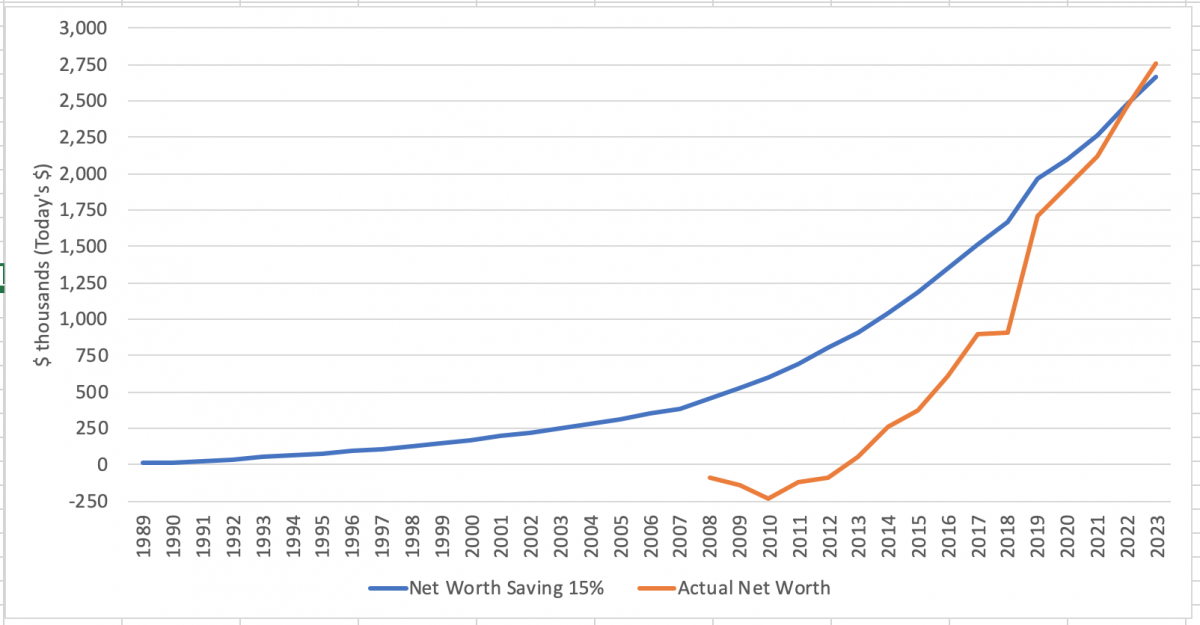

I know I have posted this before, but I updated all my data with actuals today and it still amazes me how stupid we were until we read the book The Millionaire Next Door (you can see on the graph when we got a clue). We always spent more than we made and didn't start saving anything until 2009. And then just a little in our 401k as we racked up even more debt.

Had we just saved 15% of our income since we started working and lived at our means, we would be in the same spot but with a lot less stress.

So for the young ones on the fora, please LBYM and save 15% of your gross income. You will be rich one day.

Had we just saved 15% of our income since we started working and lived at our means, we would be in the same spot but with a lot less stress.

So for the young ones on the fora, please LBYM and save 15% of your gross income. You will be rich one day.

Last edited: