mistermike40

Recycles dryer sheets

- Joined

- Aug 6, 2014

- Messages

- 365

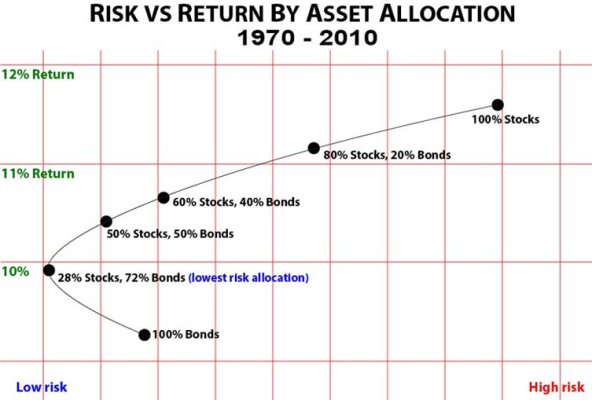

I've recently decided to shift my AA from 80/20 to 60/40. Doing a bit of Internet research (not always a wise thing to do), I found that 60/40 historical results aren't much different than 40/60 (8.7% vs 7.8%, not accounting for inflation):

https://www.financialsamurai.com/historical-returns-of-different-stock-bond-portfolio-weightings/

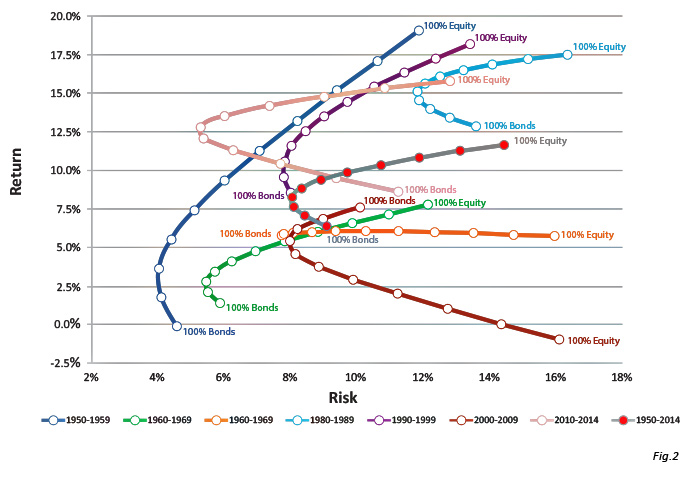

Another article claimed that 30/70 is more of a "sweet spot":

https://www.forbes.com/sites/rickferri/2015/02/06/the-center-of-gravity-for-retirees/#48984ca95dae

I have never considered going below 60/40, but the above articles make me wonder. I'm not asking what everyone's AA is (I'm sure there have been a hundred such polls conducted here)... I'm just curious if you think the above information is accurate.

https://www.financialsamurai.com/historical-returns-of-different-stock-bond-portfolio-weightings/

Another article claimed that 30/70 is more of a "sweet spot":

https://www.forbes.com/sites/rickferri/2015/02/06/the-center-of-gravity-for-retirees/#48984ca95dae

I have never considered going below 60/40, but the above articles make me wonder. I'm not asking what everyone's AA is (I'm sure there have been a hundred such polls conducted here)... I'm just curious if you think the above information is accurate.