What does the curve look like of portfolio size versus the length of time for which it's required?

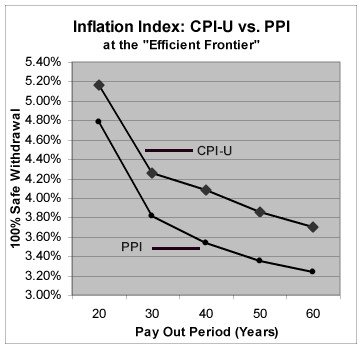

If you're going to retire for one year (say you plan on shooting yourself at the age you'll reach in a year), you can safely withdraw 100% of your portfolio and spend it on what you like, with no consequences. If you're going to retire for a thousand years (say you believe that ever-advancing developments in science and technology will allow you to live that long), you can withdraw basically all of your expected returns, since even a tiny compounding return will leave you mind-bogglingly wealthy in a thousand years, and over that much time you don't have to insure against a recession since you know you'll make it back in not too long (assuming you've got enough to live comfortably during the recessions, which you can easily do, and you automatically will after the first few decades or whatever). It's only within certain time frames that you really worry about insuring against retiring into a recession, and therefore need to limit your SWR by a few percentage points.

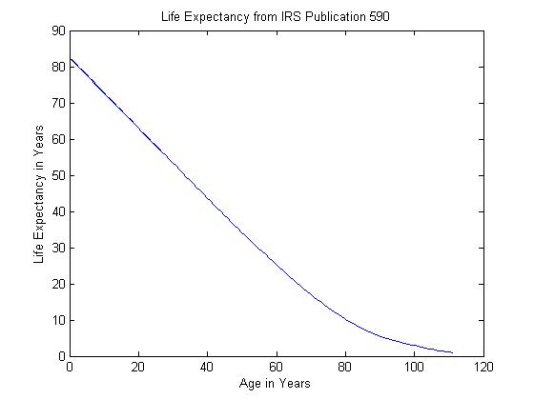

Might there be at least a percentage point difference in SWR between someone retiring in his or her 50's, compared to someone retiring in his or her 30's? (There also may be a significant difference in expected lifespan between someone born in the 1950's and someone born in the 1970's.)

Anyone have further influences on withdrawal rate versus retirement time, and does anyone want to describe what the curve will look like?

Edit: Changed "retire in one year" and "retire in a thousand years" to "retire for..." Oops, I was kind of distracted with work while I was writing this.

If you're going to retire for one year (say you plan on shooting yourself at the age you'll reach in a year), you can safely withdraw 100% of your portfolio and spend it on what you like, with no consequences. If you're going to retire for a thousand years (say you believe that ever-advancing developments in science and technology will allow you to live that long), you can withdraw basically all of your expected returns, since even a tiny compounding return will leave you mind-bogglingly wealthy in a thousand years, and over that much time you don't have to insure against a recession since you know you'll make it back in not too long (assuming you've got enough to live comfortably during the recessions, which you can easily do, and you automatically will after the first few decades or whatever). It's only within certain time frames that you really worry about insuring against retiring into a recession, and therefore need to limit your SWR by a few percentage points.

Might there be at least a percentage point difference in SWR between someone retiring in his or her 50's, compared to someone retiring in his or her 30's? (There also may be a significant difference in expected lifespan between someone born in the 1950's and someone born in the 1970's.)

Anyone have further influences on withdrawal rate versus retirement time, and does anyone want to describe what the curve will look like?

Edit: Changed "retire in one year" and "retire in a thousand years" to "retire for..." Oops, I was kind of distracted with work while I was writing this.