It's 10 PM and I'm waiting for our kid to detonate enough ordnance to scare away the impending Rat Year's evil spirits, so as lightning & thunder fill the sky (and the smoke clogs the streets) I thought I'd reprise the "How much did you spend?" threads.

2006: http://www.early-retirement.org/forums/f28/how-much-did-you-spend-2006-a-24833.html

2005: http://www.early-retirement.org/forums/showpost.php?p=352499&postcount=48

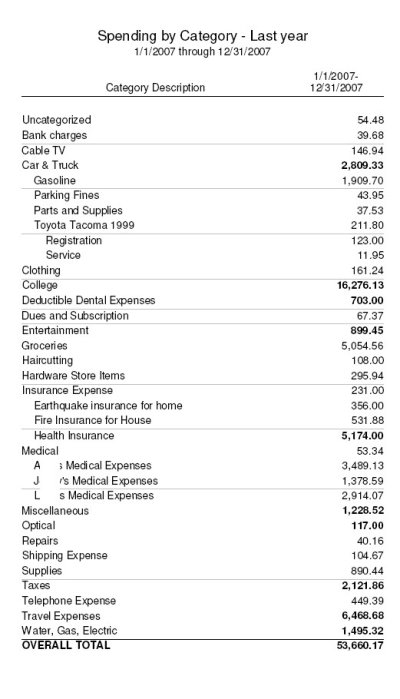

Here's the Nords family numbers for 2007:

956 Kid's allowance (includes her clothing & toiletries)

2055 Kid's school (Kumon, bus passes, school supplies)

1338 Kid's sports (tae kwon do)

11 Toys (Hey, she has a job now and can buy her own darn toys.)

514 Adult clothing (I blew $155 on myself, the rest was spouse.)

90 Kid's clothing (Spouse bought her a few freebies.)

2570 Computer (DSL, 2x laptops, UPS, laser printer.)

2113 Dining (Over a quarter of it on Costco pizza)

1300 Entertain (Including "Lion King", "Jersey Boys", and a Maui tae kwon do tournament.)

87 Surfing (Rash guards, roof racks, & wax)

1445 Dad's tae kwon do

1109 Gifts given (Including a college graduation and a long-time shipmate's wedding gift)

6016 Groceries

2073 Furniture (Spouse went nuts on Craigslist)

842 Kitchen (Vermiposting container, Fridgezilla)

315 Pets (Bunny care & boarding)

121 Tchotchkes

3236 Home improvement (Gutters, EnergyStar appliances, a few more solar panels.)

744 Car insurance

354 Home insurance

706 Personal property & liability insurance (Dropped personal property insurance this year.)

211 Investment expense (Books & magazines.)

2605 Spouse's IRA

1020 Medical & dental (TRICARE premiums, kid's dental visits)

18052 Mortgage interest

5130 Mortgage principal

1063 Federal taxes (Lotsa energy-efficiency credits this year!)

4598 Property taxes

1262 Gas

2826 Car repairs & service

304 Electricity

360 HOA dues

507 Phone

565 TV

944 Water & Sewer

13813 Vacation

$81,255 TOTAL

Right back up to the 2005 numbers.

We can discount the traditional $23K for mortgage arbitrage and a $2600 IRA contribution, but there's a definite wealth effect in home improvement, furniture, computer equipment, gifts given, and vacations. (We should probably charge half of the vacations to the college fund.) It's also getting to be time to replace both clunkers, so we're going to buy a Prius this summer and ditch the other two cars when they quit. No more $1500 repair bills.

My $36K military pension is carrying the majority of the load. Spouse put her Reserve income in her TSP this year so we spent money from taxable accounts to make up the difference. We're a bit over 4% in 2007 and the Prius will probably put us over 4% in 2008, but if we back out the TSP & IRA contributions then we're back under 4%. We're looking at a cap-gains tax bill for converting a mutual fund to an ETF, too, so next year's spending seems to be heading even higher. But if the economy went to hell in a handbasket and took the market with it, we have room to delay or cut spending.

We've tracked these posted items on the board for three years now, and most of them have bounced around more from our own variability than from inflation. Going back over the last decade in our Quicken records, family & lifestyle changes have obliterated any potential inflation trends. Property taxes & water/sewer are clearly rising, but not enough to scare us into adjusting the budget. (Property taxes will probably drop in 2008.) A couple more years of data could show a trend, but in 2010 we're launching the kid from the nest and a bunch of spending will drop off the budget. So far this data is useless for determining a personal inflation rate and I suspect that most families with kids are in the same situation.

If I was planning an ER budget all over again then I would've added more for home improvement, furniture, and vacation. Sure, I accounted for them, but I underestimated the psychological effects of a rising stock market and incredible deals on Craigslist. Of course those would also be the first categories to be cut for belt-tightening, and there would be further budget-cutting margin if necessary.

It was a very good year!

2006: http://www.early-retirement.org/forums/f28/how-much-did-you-spend-2006-a-24833.html

2005: http://www.early-retirement.org/forums/showpost.php?p=352499&postcount=48

Here's the Nords family numbers for 2007:

956 Kid's allowance (includes her clothing & toiletries)

2055 Kid's school (Kumon, bus passes, school supplies)

1338 Kid's sports (tae kwon do)

11 Toys (Hey, she has a job now and can buy her own darn toys.)

514 Adult clothing (I blew $155 on myself, the rest was spouse.)

90 Kid's clothing (Spouse bought her a few freebies.)

2570 Computer (DSL, 2x laptops, UPS, laser printer.)

2113 Dining (Over a quarter of it on Costco pizza)

1300 Entertain (Including "Lion King", "Jersey Boys", and a Maui tae kwon do tournament.)

87 Surfing (Rash guards, roof racks, & wax)

1445 Dad's tae kwon do

1109 Gifts given (Including a college graduation and a long-time shipmate's wedding gift)

6016 Groceries

2073 Furniture (Spouse went nuts on Craigslist)

842 Kitchen (Vermiposting container, Fridgezilla)

315 Pets (Bunny care & boarding)

121 Tchotchkes

3236 Home improvement (Gutters, EnergyStar appliances, a few more solar panels.)

744 Car insurance

354 Home insurance

706 Personal property & liability insurance (Dropped personal property insurance this year.)

211 Investment expense (Books & magazines.)

2605 Spouse's IRA

1020 Medical & dental (TRICARE premiums, kid's dental visits)

18052 Mortgage interest

5130 Mortgage principal

1063 Federal taxes (Lotsa energy-efficiency credits this year!)

4598 Property taxes

1262 Gas

2826 Car repairs & service

304 Electricity

360 HOA dues

507 Phone

565 TV

944 Water & Sewer

13813 Vacation

$81,255 TOTAL

Right back up to the 2005 numbers.

We can discount the traditional $23K for mortgage arbitrage and a $2600 IRA contribution, but there's a definite wealth effect in home improvement, furniture, computer equipment, gifts given, and vacations. (We should probably charge half of the vacations to the college fund.) It's also getting to be time to replace both clunkers, so we're going to buy a Prius this summer and ditch the other two cars when they quit. No more $1500 repair bills.

My $36K military pension is carrying the majority of the load. Spouse put her Reserve income in her TSP this year so we spent money from taxable accounts to make up the difference. We're a bit over 4% in 2007 and the Prius will probably put us over 4% in 2008, but if we back out the TSP & IRA contributions then we're back under 4%. We're looking at a cap-gains tax bill for converting a mutual fund to an ETF, too, so next year's spending seems to be heading even higher. But if the economy went to hell in a handbasket and took the market with it, we have room to delay or cut spending.

We've tracked these posted items on the board for three years now, and most of them have bounced around more from our own variability than from inflation. Going back over the last decade in our Quicken records, family & lifestyle changes have obliterated any potential inflation trends. Property taxes & water/sewer are clearly rising, but not enough to scare us into adjusting the budget. (Property taxes will probably drop in 2008.) A couple more years of data could show a trend, but in 2010 we're launching the kid from the nest and a bunch of spending will drop off the budget. So far this data is useless for determining a personal inflation rate and I suspect that most families with kids are in the same situation.

If I was planning an ER budget all over again then I would've added more for home improvement, furniture, and vacation. Sure, I accounted for them, but I underestimated the psychological effects of a rising stock market and incredible deals on Craigslist. Of course those would also be the first categories to be cut for belt-tightening, and there would be further budget-cutting margin if necessary.

It was a very good year!