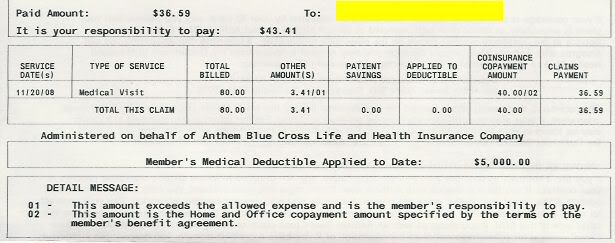

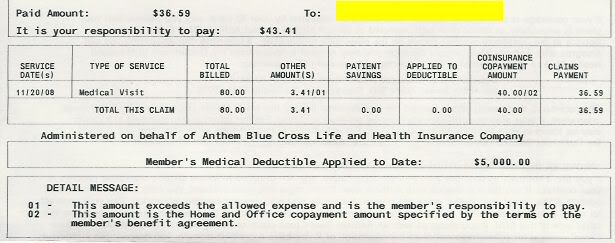

The deductible and the out of pocket maximum are two different things -- meeting a deductible doesn't typically mean the patient pays nothing more out of pocket. Before the $5,000 deductible is met the patient pays the entire negotiated (in-network) bill. After the deductible is met, insurance kicks in and pays everything above the copayment. Those copayments are still paid by the patient until the plan's out of pocket maximum is reached.

So there are three "tiers" in this:

(1) Before the patient has paid $5,000 out of pocket (the deductible), insurance pays nothing and the patient pays the full balance due;

(2) After the patient has paid the full deductible and before the annual out of pocket maximum is paid, the patient still has a copay but insurance pays the rest;

(3) After the total out of pocket maximum has been paid by the patient, insurance gets the rest without a copayment.

If this provider was in the BC/BS network, that disallowed $3.41 shouldn't even be your responsibility.