Going back to October 2007, knowing what you know NOW, what would you have done different regarding your portfolio, investments, lifestyle etc OR would you do everything the same.

Secondly,knowing what you know now how will you prepare for the NEXT stock market dip(azzuming there will be one)

Sorry to be blunt, but this is really a question that leads nowhere.

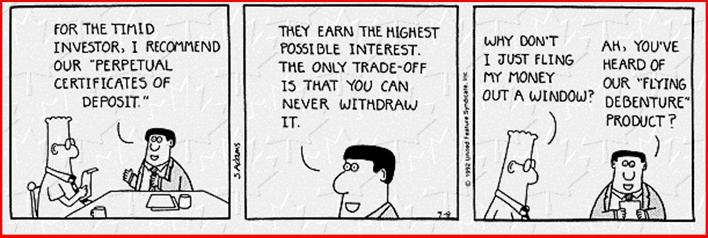

Actually that's what everyone fills out on their "investor risk tolerance" questionnaires. And we all say that we can handle just about any market volatility-- until we have to handle any market volatility. Or we say that we want to be "absolutely safe" and then kick ourselves when the market jumps 20% one year and we're in 5% CDs. It's one thing to be a Vulcan investor and quite another to watch the daily hemorrhage.

It's sure not our first time. Our ER portfolio was whacked 40% after 9/11 and we took a pretty big hit in Oct 1987 (don't remember how much, long research project to figure it out, but probably at least 20%). So losing 40% in the last 15 months has been deja vu all over again. Our response back then was to throw every penny we had into the stock market and DCA like mad. Of course we were working back then, too.

In this case, after six years of ER, we got from "Woo-hoo!" to "This is unbelievable" to "This is just freakin' stupid" without any tripwires. I expected things to back off 20% and we could all get on with our lives. After all, we'd just finished selling off our last mutual fund a few months before that and we were about to start rebalancing everything into our dream asset allocation. I was even going to slowly get rid of our individual stocks over the next few years. We had a plan, it already involved playing plenty of taxes, and it was not a time to "take some off the table."

Frankly it felt like Monopoly money. My pension check kept coming, our tenants kept paying the rent, and our home didn't drop significantly in value. Why fret about the market?

One thing I've learned is that investing can be very hard work. The process of picking the best assets requires several hours of daily effort-- research, spreadsheet models, price points, and patience. I've also learned that I'm lazy. Index funds are a great deal for those who want to capture an outsize portion of market returns with obscenely little effort.

We still believe in a keeping a high-equity portfolio, and in rebalancing to stay within 20% of each asset's allocation, but dividends are going to be reinvested a little differently. When our ETFs rise above their long-term averages then we'll start taking the dividends in cash (money market or CDs) until one of our assets is below their long-term average.

And when we get back to "Woo-hoo!" territory, if we're tempted to give into the wealth effect then we'll raise twice the cash we think we need. That'll give us significant pause before making a major purchase, and it'll make us think about whether we need to be getting ready for another reversion to the mean.