Onward

Thinks s/he gets paid by the post

- Joined

- Jul 1, 2009

- Messages

- 1,934

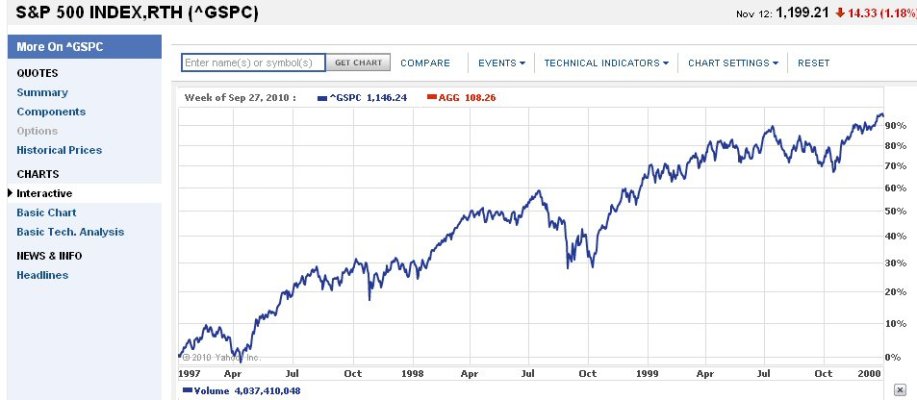

This illustration was given on Consuelo Mack's Wealthtrack today. I haven't checked the numbers, but it does make one think.

Three brother retire within a six-year time period. Each puts $1,000,000 into an S&P index fund and withdraws $5,000/month. No adjustments for inflation.

Brother 1 retires Jan 1, 1997.

Brother 2 retires three years later, Jan 1, 2000.

Brother 3 retires another three years later, Jan 1, 2003.

Fast forward to mid-2010:

Brothers 1 & 3 have portfolios valued at over $1,000,000 each.

Brother 2's portfolio is under $250,000.

Three brother retire within a six-year time period. Each puts $1,000,000 into an S&P index fund and withdraws $5,000/month. No adjustments for inflation.

Brother 1 retires Jan 1, 1997.

Brother 2 retires three years later, Jan 1, 2000.

Brother 3 retires another three years later, Jan 1, 2003.

Fast forward to mid-2010:

Brothers 1 & 3 have portfolios valued at over $1,000,000 each.

Brother 2's portfolio is under $250,000.