Greetings! I want to thank all of the posters and organizers of this site. What a wonderful resource.

I am 57, DW is 59. DW er'd in Feb 2010. Home (300k) paid for, 500K in ret accounts, 500K in non-ret accounts, 1M total, 70% stock, 20% bond, 10% cash, always LBOM, no debt. Just finished remod on most of the home, a few more things to take care of (paint, carpet etc). Our two kids are pretty much FI. No pensions - our nest egg of $1M and counting, plus SS will be it for us. COL is relatively low where we live.

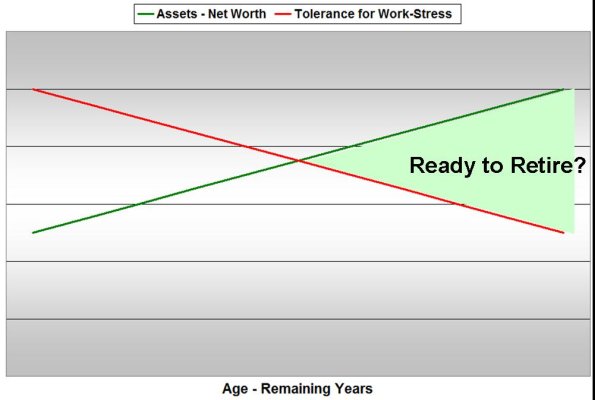

I have been fortunate to earn about 250K per year for the past couple of years. Before then, we both worked and earned around 100K per year. We still live like we earned much less. I enjoy the work, but the environment (large corporate) can be very stressful.

My current plan is to keep piling up the savings. I would retire as early as Jan 2011 and draw 60K per year. Would reduce draw when SS kicked in at 62. Longer I can last, the better it will be financially.

It is easier to put up with the stress of the job knowing that I could walk away, so I may be able to last longer than I think.

My son would like to buy or start his own business, and he is saving to do so -at 24 he has saved around 100K. He hopes to do this in about 2 to 3 years. I hope to quit at that time and help him with his business. We get along very well and for me, this would be my dream retirement, working with my son.

My fears? Leaving the security of a 250K job and paying for health care on my own until medicare. Will 1M really be enough? It is 10 times what we made for most of my career, but not much compared to what I make currently.

Any thoughts?

I am 57, DW is 59. DW er'd in Feb 2010. Home (300k) paid for, 500K in ret accounts, 500K in non-ret accounts, 1M total, 70% stock, 20% bond, 10% cash, always LBOM, no debt. Just finished remod on most of the home, a few more things to take care of (paint, carpet etc). Our two kids are pretty much FI. No pensions - our nest egg of $1M and counting, plus SS will be it for us. COL is relatively low where we live.

I have been fortunate to earn about 250K per year for the past couple of years. Before then, we both worked and earned around 100K per year. We still live like we earned much less. I enjoy the work, but the environment (large corporate) can be very stressful.

My current plan is to keep piling up the savings. I would retire as early as Jan 2011 and draw 60K per year. Would reduce draw when SS kicked in at 62. Longer I can last, the better it will be financially.

It is easier to put up with the stress of the job knowing that I could walk away, so I may be able to last longer than I think.

My son would like to buy or start his own business, and he is saving to do so -at 24 he has saved around 100K. He hopes to do this in about 2 to 3 years. I hope to quit at that time and help him with his business. We get along very well and for me, this would be my dream retirement, working with my son.

My fears? Leaving the security of a 250K job and paying for health care on my own until medicare. Will 1M really be enough? It is 10 times what we made for most of my career, but not much compared to what I make currently.

Any thoughts?

Yes, the house is modest compared to a lot of the others in our neighborhood. I follow my dad's advice about houses. When I asked him why we did not have a bigger house when I was a kid. He said, "Son, you can't eat your house." That was a simple statement from a simple man who earned his living as a steamfitter and never used credit. He paid cash for our home and cars. He also built up large cash reserves to get through the times when the steamfitters were on strike.

Yes, the house is modest compared to a lot of the others in our neighborhood. I follow my dad's advice about houses. When I asked him why we did not have a bigger house when I was a kid. He said, "Son, you can't eat your house." That was a simple statement from a simple man who earned his living as a steamfitter and never used credit. He paid cash for our home and cars. He also built up large cash reserves to get through the times when the steamfitters were on strike.