Fireup2020

Thinks s/he gets paid by the post

- Joined

- Feb 5, 2007

- Messages

- 1,250

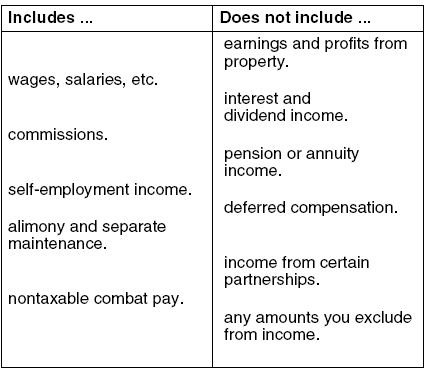

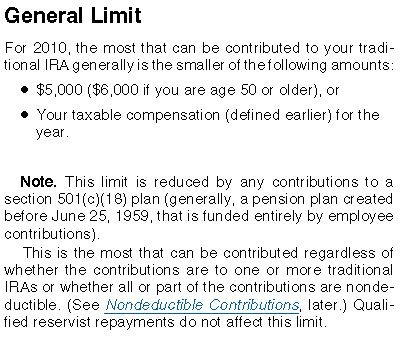

"Roth IRA accounts can only accept money paid in that has come from taxable compensation, otherwise referred to as taxable income."

Am I correct in reading this that I will be able to contribute to a Roth account from my pension funds since they will be taxed by Uncle Sam?

If we can get a tax break, this seems to make sense to add to savings this way.

Your opinions?

Am I correct in reading this that I will be able to contribute to a Roth account from my pension funds since they will be taxed by Uncle Sam?

If we can get a tax break, this seems to make sense to add to savings this way.

Your opinions?