DebER

Dryer sheet aficionado

Hi, I am looking for an income investment (stream) with at least a modest amount of growth. I have approx. $150K to invest. I do not want to reinvest the dividends, but use the cash to supplement my income.

I have some mutual funds in a retirement account that I am currently contributing to w/a value of about $65K and a private reit (retirement account) w/a value of about $53K along w/some other individual stocks with a value of about $25K as well as emergency cash.

I will not be retiring for about 12 more years and my only debt is my home.

I am the main bread winner in the home and the income stream will help will bills and afford us the opportunity to breathe a little easier.

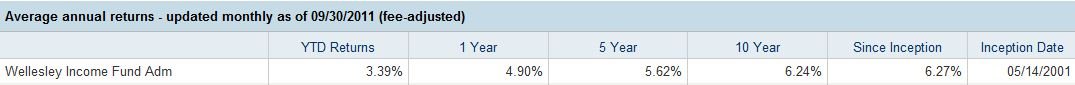

I've looked at these 3 funds. I'd like to realize at least a 5% return. I know a lot of you like Vanguard funds, but the return isn't what I'd like to receive. Any thoughts on the below? Thanks so much.

TGLMX, TGBAX, THOPX

I have some mutual funds in a retirement account that I am currently contributing to w/a value of about $65K and a private reit (retirement account) w/a value of about $53K along w/some other individual stocks with a value of about $25K as well as emergency cash.

I will not be retiring for about 12 more years and my only debt is my home.

I am the main bread winner in the home and the income stream will help will bills and afford us the opportunity to breathe a little easier.

I've looked at these 3 funds. I'd like to realize at least a 5% return. I know a lot of you like Vanguard funds, but the return isn't what I'd like to receive. Any thoughts on the below? Thanks so much.

TGLMX, TGBAX, THOPX