boatfishandnature

Recycles dryer sheets

- Joined

- Aug 18, 2011

- Messages

- 106

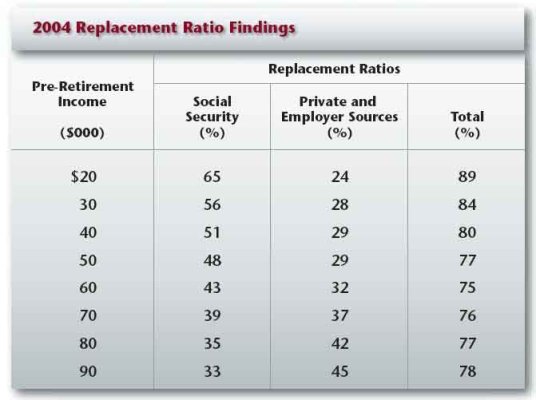

I know that this topic has been extensively discussed and the usual answer is either "70% or so of pre-retirement income" or " varies from person to person, calculate your expenses". But on the 70% rule, surely there is a maximum amount beyond which it is a diminishing % as income raises, no? At the extreme, surely Bill Gates and Warren Buffett do not need 70% of their current income in order to retire?

Has there been any more formal thinking around this diminishing % concept? Ideas?

Has there been any more formal thinking around this diminishing % concept? Ideas?

Sold mine before I retired.

Sold mine before I retired.