rsingh6675

Recycles dryer sheets

- Joined

- Nov 16, 2008

- Messages

- 126

Is it a good idea to pay 25% Tax & convert IRA to ROTH IRA? I am 63yr old.

Thanks

Thanks

In most cases, NO. If you wait and convert over time after you retire, assuming that your are in a lower tax bracket, you will be better off.

I was in the 28% bracket last year when I was working, and will be converting amounts as needed to fill the 15% tax bracket over the next few years and paying ~10% of the amounts converted.

I am 63 year old.

I am retired.

I am taking soc sec + I am withdrawing from my IRA funds to top 15% tax bracket.

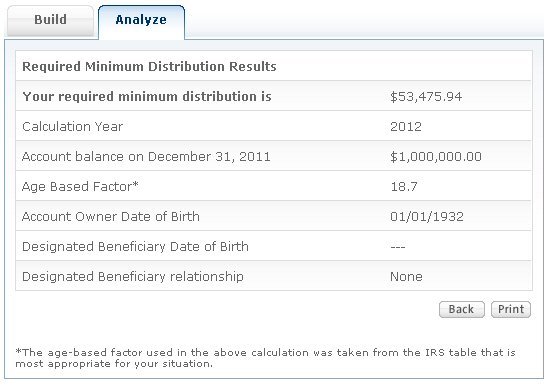

Now the question is---For a 63 yr old individual, is it better to convert some money to ROTH IRA every year, paying 25% Federal Tax or will it be better to keep money in IRA until 70 & pay RMD when I turn 70&1/2?

I still figure that if you don't care about the estate you leave behind, RMDs are irrelevant.

Also remember that although you must withdraw the RMD, you are not required to spend it.

After putting my Roth conversion situation through models, both online and spreadsheet, I determined that it would be MUCH better to simply make my domicile in a non income tax state. I don't want to get the thread off topic, but just want to put things in perspective. Pay now at known tax rates, pay later at unknown tax rates... there's a lot of 'play' in that analysis.

Absolutely true, but you ARE required to include RMDs in your taxable income. If you had been able to "game" the system (one possible game is to "Roth" some of your tIRA/401(k)) you might end up with a lower life-time tax bill. True, it might not turn out the way you planned, but if your plan works, you could save a significant amount of taxes. I'm only suggesting that you need to at least consider playing the game. If you decide not to (or you think it''s a wash), so be it. But, we have been given this "gift" of the Roth. It's not perfect and playing the game is fraught with dangers and pitfalls, but it's the best game in town for many of us, IMHO of course. And yes, YMMV.

I'm 80 years old, and if I don't start taking at least $50K out each year, I'm going to die with money left in the bank. I could take $50K out until I'm 100, and still not use up my money. Let's say I Roth'd the system, and didn't have any RMDs. Would I take out less than $50K?

Just for fun, I found that if I'm 100 years old and I still have $1,000,000 in the bank, the government says I must take out $158,000 each year.

Please let me know if this makes sense, because I'm basing my strategy on it.

If you need something to worry about you could always hire a distant relative to remodel your kitchen...If these are the worst problems we have in life then it's all good.