THANK YOU, THANK YOU, THANK YOU Clifp and Katsmeow for coming to my rescue! You are both fabulous! I was up until 2 AM trying to come up with those percentage numbers for you. Whew!

Your data is absolutely correct. Again, thank you for figuring those percentages out for me and I'm sending {{{hugs}}} your way.

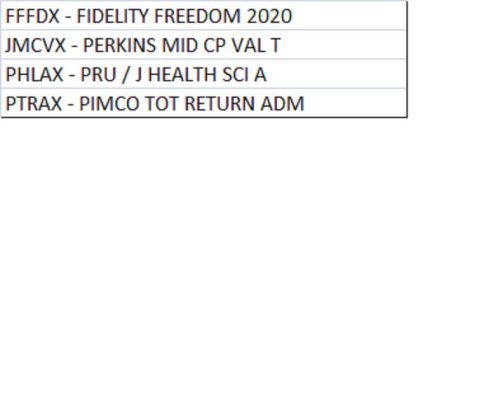

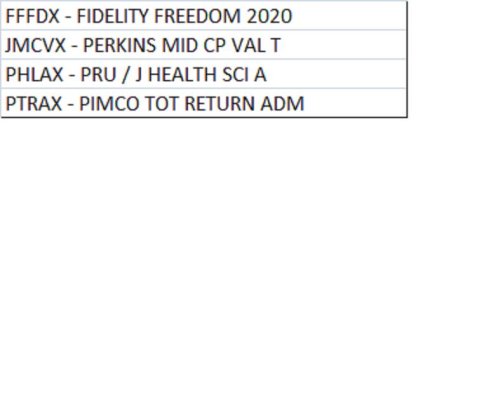

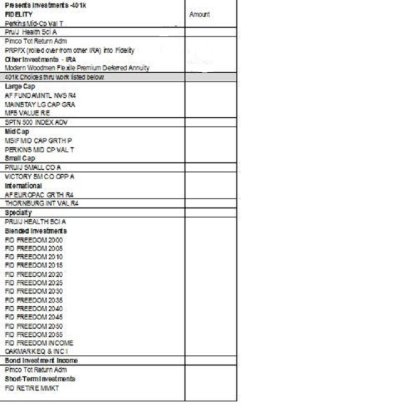

I attached a listed of my 401k options at Fidelity at work. And as mentioned earlier, with the IRA which is also with Fidelity I have many options to choose from.

I know my portfolio is quite "conservative" but having gone through a divorce and the inability to save as I should have for a number of years. Surviving as a single individual today can be quite challenging, especially if you own a home, plus there was also two job losses within the the 12 yrs, however, I knew once I was in a better financial as situation I could focus one again on "saving like mad" and contributing my income toward retirement savings. And since I only have 10-12 yrs and the market is so crazy, and knowing I will need these funds to financially survive since it's just little old me, I tend to be more on the conservative side in choices.

I did make one VERY big stupid mistake a few years ago. I had a good portion of my funds in American Funds and $$$ like everyone else and panicked, ran to my financial adviser who gave me very bad advise. He told me since I was so concerned about losing so much $$$ to pull out the $$$ in the American Funds and put it into the Modern Woodmen Flexible Premium Deferred Annuity I presently have; you can send me a cyber slap here. As a single women with no really good financial advise I trusted him. I only wish I knew of this forum then.

But that was then and this is now, and we can only move forward. I would like to also open up a Roth IRA haven't didn't where yet, and totally lost on fund direction. I attached a snap shot of my fund choices at work for the 401k.

Again, you are just awesome and brought a big smile to my face for providing me your assistance.

Clif, Katsmeow, thanks for your forensic persistence. I couldn't connect those dots, especially with figuring out the annuity contribution to the overall AA.

I don't know how to say this tactfully, so I'm just going to say it.

Rose, in my opinion you're asking for advice that you're not yet ready to use. As near as I can tell from your posts in this thread, you're asking us to recommend which funds you should add to your 401(k). And then you're going to want to know what funds you should hold in the rest of your portfolio to balance out the decisions you've made for your 401(k).

But you've already talked about panicking during adversity and trusting a bad advisor. What makes you think our advice is going to be any better? More to the point, what makes you think that you're going to stick with our advice when the market drops 15-20% this summer, shortly after you implement our suggestions?

I've been on this board for a while, and we've seen this issue before from posters who haven't thought out their investment plan or their asset allocation. They don't take the time to educate themselves by reading the books that we recommend here, but they ask plenty of questions about the subject. They don't take the time to work through the Bogleheads Wiki on investing, but they ask all sorts of questions about what funds to buy for their accounts. They have all sorts of questions about asset allocation but they can't articulate their holdings or their percentages. They use vocabulary like "safe" or "conservative" without appreciating the context of those terms in an investing environment. They know an annuity is "bad" but they want to pick 401(k) funds instead of addressing the entire portfolio issue.

In some cases, they get their feelings hurt because they think they're "not doing it right" or "newbies". But what's really the issue is that they're not taking the time to educate themselves. They're blindly grasping for advice and trying to implement the first reasonable suggesting they get with little or no comprehension of why they should do it.

I suggest that you do yourself a favor. Hold off trying to pick funds for your 401(k) until later this year or even until early 2013. Take the time between now and then to read through the Bogleheads Wiki about getting started on a new investment plan:

Getting Started - Bogleheads . Read the material and then ask questions about it, instead of trying to skip to the last step and buy our fund recommendations. Once you feel comfortable with the process and the vocabulary, then design your own investment plan and ask questions about asset allocation. As you go through this exercise, you'll start to figure out for yourself which funds fit your criteria and your investing tolerance. You won't have to pingpong back & forth among a conflicting set of suggestions from anonymous Internet strangers.

Best of all, the process of educating yourself will give you the confidence to stick with your plan through a bear market. The way you're doing it now is cheaper than using a financial advisor, but it's not better.

Whichever method you choose of optimizing your portfolio, I wish you success. If you choose the method you're trying right now, then I wish you good luck-- you're gonna need it.

If you decide to work on the Bogleheads wiki then I look forward to your new thread on the subject. In any case, I'm done with this thread... and hopefully you are too.