MasterBlaster

Thinks s/he gets paid by the post

- Joined

- Jun 23, 2005

- Messages

- 4,391

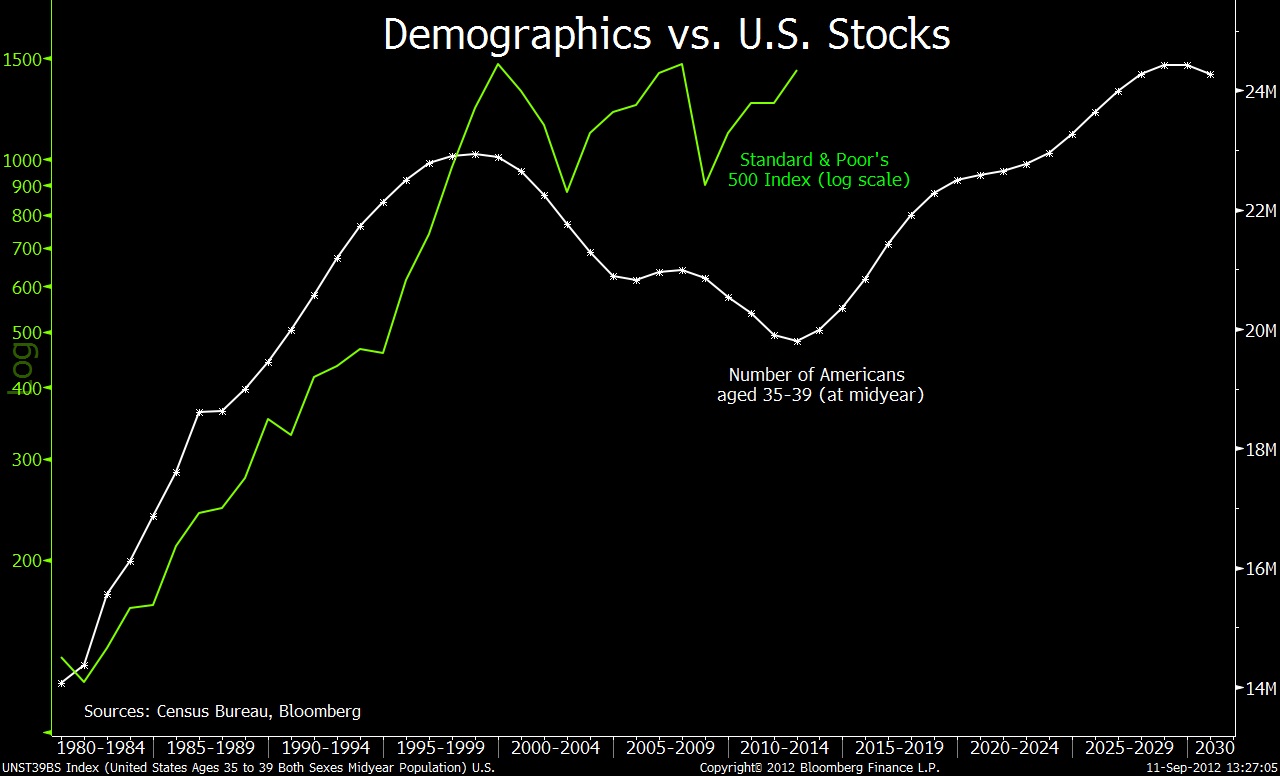

yet another article on the tough-times ahead and the futility of the Feds action. The article suggests it's a tough uphill struggle against retiring Boomers life-cycle spending patterns driving the economy.

Are Stocks Doomed by Demographics? - Businessweek

Are Stocks Doomed by Demographics? - Businessweek

An economics blog posted a depressing speech given by author and newsletter writer Harry Dent, called “A Decade of Volatility: Demographics, Debt, and Deflation.” “There is,” Dent says, “simply no way the Fed can win the battle it’s currently waging against deflation, because there are 76 million Baby Boomers who increasingly want to save, not spend. Old people don’t buy houses!”

He explains that the peak of the recent housing boom featured upper-middle-class families living in 4,000-square-foot McMansions. “About ten years from now,” he says, “what will they do? They’ll downsize to a 2,000-square-foot townhouse. What do they need all those bedrooms for? The kids are gone. They don’t visit anymore. Ten years after that, where are they? They’re in 200-square-foot nursing homes. Ten years later, where are they? They’re in a 20-square-foot grave plot. That’s the future of real estate. That’s why real estate has not bounced in Japan after 21 years. That’s why it won’t bounce here in the U.S. either. For every young couple that gets married, has babies, and buys a house, there’s an older couple moving into a nursing home or dying.”