Posted for just for the numbers, and general information. Not to make any particular point.

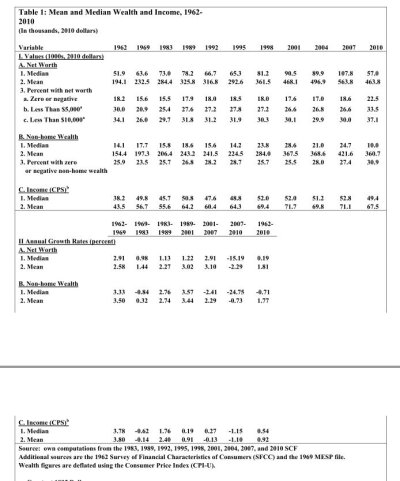

Median Net Worth In 2010 At Lowest Level Since 1969: Report

The first link in the article goes to the study, and a .pdf file that goes into more detail on subjects such as pensions, wages, home ownership, stock ownership etc.

The paper further discusses the effects on society as a whole, including stability and future well being.

Median Net Worth In 2010 At Lowest Level Since 1969: Report

The first link in the article goes to the study, and a .pdf file that goes into more detail on subjects such as pensions, wages, home ownership, stock ownership etc.

The paper further discusses the effects on society as a whole, including stability and future well being.

Last edited: