Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

Like many at the end of each year, I spent several hours summarizing our budget results yesterday. Along the same lines as the recent 'how much did you spend in 2012' thread - I thought I'd start another 'I'll show you mine if you show me yours' thread showing a little more history. Getting better or getting worse?

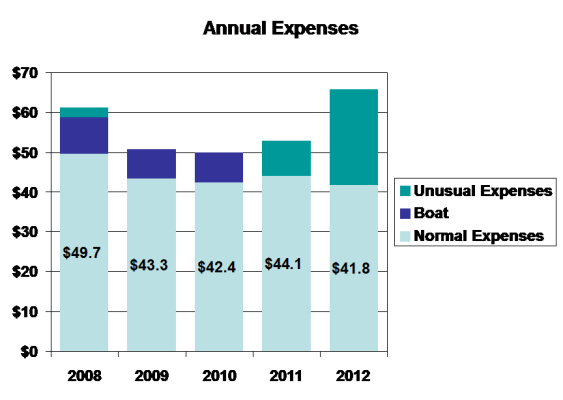

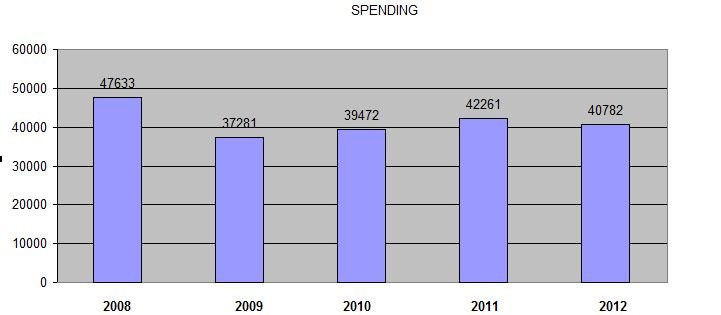

What my history tells me is we have a really good handle on what we spend, very steady if not improving slightly from year to year. And that our ultra conservative WR lets us sleep well at night - at least until the next market meltdown.

I separate non-annual expenses such as purchasing cars, major home repairs/renovation, furniture/appliance/consumer electronics replacements into unusual expenses. I plan unusual expenses at $10K/yr (coincidence, not arbitrary) on average, knowing they will flucuate considerably. I've also shown 'boat' as a separate category simply to see how we're doing with all the other typical expense categories we all face. If you've ever owned a boat, you know they're more expensive than most people expect.

DW was laid off in 2008, so we really took a hard look at spending then. I retired in 2011, and we've continued to find ways to reduce spending without sacrificing quality of life at all. We cut out some non-value added spending, and just reduced frequency on some value added spending categories. The details have appeared in other threads. I'd argue we're actually living better, while spending less, it's immensely satisfying.

FWIW...

What my history tells me is we have a really good handle on what we spend, very steady if not improving slightly from year to year. And that our ultra conservative WR lets us sleep well at night - at least until the next market meltdown.

I separate non-annual expenses such as purchasing cars, major home repairs/renovation, furniture/appliance/consumer electronics replacements into unusual expenses. I plan unusual expenses at $10K/yr (coincidence, not arbitrary) on average, knowing they will flucuate considerably. I've also shown 'boat' as a separate category simply to see how we're doing with all the other typical expense categories we all face. If you've ever owned a boat, you know they're more expensive than most people expect.

DW was laid off in 2008, so we really took a hard look at spending then. I retired in 2011, and we've continued to find ways to reduce spending without sacrificing quality of life at all. We cut out some non-value added spending, and just reduced frequency on some value added spending categories. The details have appeared in other threads. I'd argue we're actually living better, while spending less, it's immensely satisfying.

FWIW...

Attachments

Last edited: