Alex in Virginia

Recycles dryer sheets

- Joined

- Dec 23, 2012

- Messages

- 145

Hey, folks...

John Hancock just dropped the other shoe on me. They got their long-awaited rate increase for long term care policies issued in Maryland.

They told me I'll be getting my "options package" in June ahead of my August renewal, but they also told me that lifetime policies such as I have will have up to a 90% rate increase.

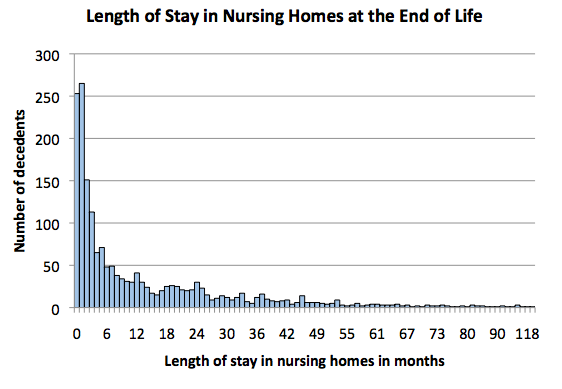

I'm trying to get ahead of the ball here. I'm sure one of my options will be to reduce the length of my coverage from "lifetime" to something else. And so my question really is: how long would be long enough, based on the odds? How many years of coverage would keep me reasonably safe from ending up paying gigantic long term care bills some time in the future?

Any experiences or ideas? Any studies or references I can check up?

Thanks loads!

Alex in Virginia

John Hancock just dropped the other shoe on me. They got their long-awaited rate increase for long term care policies issued in Maryland.

They told me I'll be getting my "options package" in June ahead of my August renewal, but they also told me that lifetime policies such as I have will have up to a 90% rate increase.

I'm trying to get ahead of the ball here. I'm sure one of my options will be to reduce the length of my coverage from "lifetime" to something else. And so my question really is: how long would be long enough, based on the odds? How many years of coverage would keep me reasonably safe from ending up paying gigantic long term care bills some time in the future?

Any experiences or ideas? Any studies or references I can check up?

Thanks loads!

Alex in Virginia