There's so much discussion about having enough money in retirement, SSI, etc., I wonder what the reality is for most on this board.

There's talk about drawing down but at a reasonable rate so you won't be left with much when you die, but you won't be impoverished.

How many of you are actually still saving and increasing your net worth, and how many are drawing from their savings to fund retirement?

I had a friend who's step dad had a few months to live. He bragged how he saved all his pension checks and his big expense was going out to eat once a week while having his caddy washed/waxed.

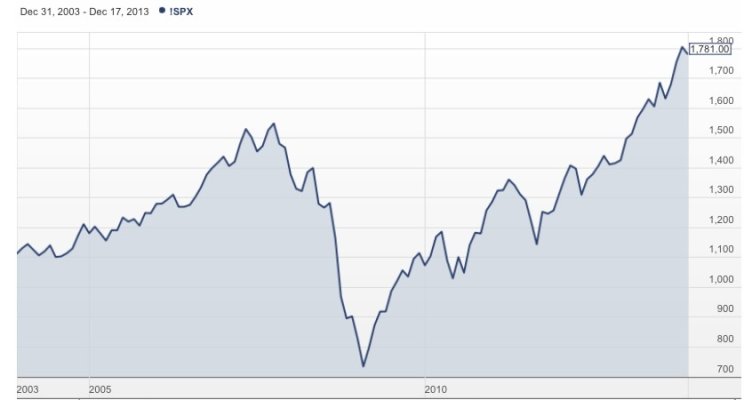

So, is your portfolio growing or declining?

There's talk about drawing down but at a reasonable rate so you won't be left with much when you die, but you won't be impoverished.

How many of you are actually still saving and increasing your net worth, and how many are drawing from their savings to fund retirement?

I had a friend who's step dad had a few months to live. He bragged how he saved all his pension checks and his big expense was going out to eat once a week while having his caddy washed/waxed.

So, is your portfolio growing or declining?