It depends on how much the yield of that bond rises or falls.

As a refresher (for myself too), the present value of a bond is the sum of the discounted value of its income stream and the discounted value of its principal that is paid back at maturity.

Here's an example. For a 10-yr bond of $1000 principal paying 3% interest a year ($30/yr), if the current interest rate (or inflation?) is 0%, then its value is $1000 + 10 * $30 = $1300. If the current rate is 3%, then the discounted value of the interest payments is $255.906 and that of the principal is $744.09, and the sum is exactly $1000. The first case is trivial and can be easily seen. The latter case is more complicated, yet the result is as can be expected, because the interest payment exactly cancels out the inflation.

The actual formulas are PVA =

I[1-(1+k)^-n]/k and PV = FV/

(1+k)^n, where PVA and PV are the values of the interest stream and the principal, FV is the returned principal at maturity, I is the annual interest payment,

k is the current interest rate (inflation rate?), and

n is the number of annual payments. Note that when

k=0, then the formula blows up but we already know that PVA = I * n, and PV = FV for that limiting trivial case. Or if one wants to be fancy, remind yourself of freshman calculus and take the limit when k approaches 0.

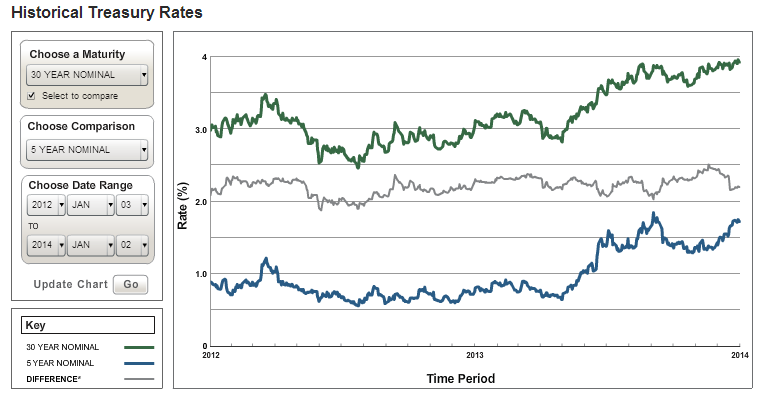

The problem is the new interest rate is assumed constant in the remaining duration of the bond, which we know is not true. And the bond yields of different duration often have a strenuous relationship. Long bonds should have a higher coupon rate than short-duration bonds, but the yield curve has been inverted in the past.

And in the above formula, should I use expected inflation rate which reflects the discounted value of the principal and interest stream, or do I use the current bond yield which shows the lost opportunity relative to selling this bond and buying a new one now?

It's really weird stuff, and I admit that I have not been following this closely in the past. I made most of my money from stocks, but now that I am not working and have more time when not RV'ing, I am willing to learn a new trick.

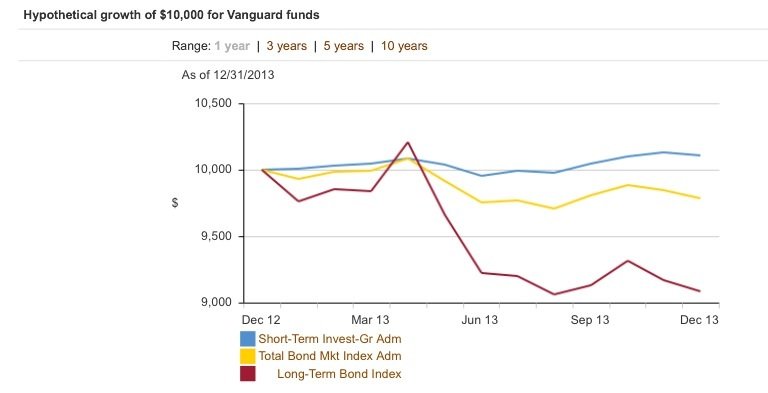

However, I will note that if the bond yield changes 2% from a high value like 6% to 8%, the effect is nowhere as big as a change from a low value of 2% to 4%, which we observed recently.

"In theory there is no difference between theory and practice. In practice there is." -- YogiBerra