- Joined

- Oct 13, 2010

- Messages

- 10,735

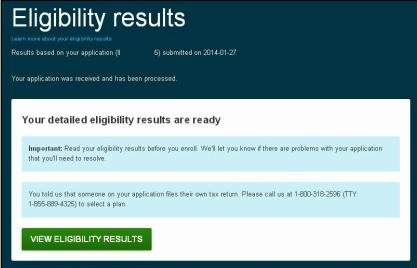

I would like to get feedback on the process of signing up through healthcare.gov from people who have done it. Specifically in the process surrounding estimated income when your most current 1040 shows working full time, but your 2014 1040 will show very little income.

My recent "last regular paycheck of my life", plus interest and dividends (estimated from last year's taxes) might get me to about 70% FPL. But of course I can Roth convert to pull that up to wherever I want (over 137%, for sure). I've got a carry forward loss, so I guess I can net that out too?

Anyway, I wondered if anyone has gone through the process and has any pointers or gotchas for me. Did you need to send in something that "proves" you're no longer employed? I understand that I need to get this done by the 15th of the month to have it effective on the first of March. My plan is to not reject COBRA (but not accept it either...I have 60 days). In that time, I expect little or no use of the medical system, but if something bad does happen, I'll sign-up for COBRA.

So, has anyone gone through estimating 2014 retirement income (with regular 2013 wages) on the federal site? (I know Brewer12345 has on his state site). Any pointers for negotiating this on healthcare.gov?

My recent "last regular paycheck of my life", plus interest and dividends (estimated from last year's taxes) might get me to about 70% FPL. But of course I can Roth convert to pull that up to wherever I want (over 137%, for sure). I've got a carry forward loss, so I guess I can net that out too?

Anyway, I wondered if anyone has gone through the process and has any pointers or gotchas for me. Did you need to send in something that "proves" you're no longer employed? I understand that I need to get this done by the 15th of the month to have it effective on the first of March. My plan is to not reject COBRA (but not accept it either...I have 60 days). In that time, I expect little or no use of the medical system, but if something bad does happen, I'll sign-up for COBRA.

So, has anyone gone through estimating 2014 retirement income (with regular 2013 wages) on the federal site? (I know Brewer12345 has on his state site). Any pointers for negotiating this on healthcare.gov?