Hello All,

Just retired after a 22 1/2 year stint as a deputy sheriff in Oregon. I am 52 years old and started working as an investigator for a public defender in Marion County where they do not have PERS.

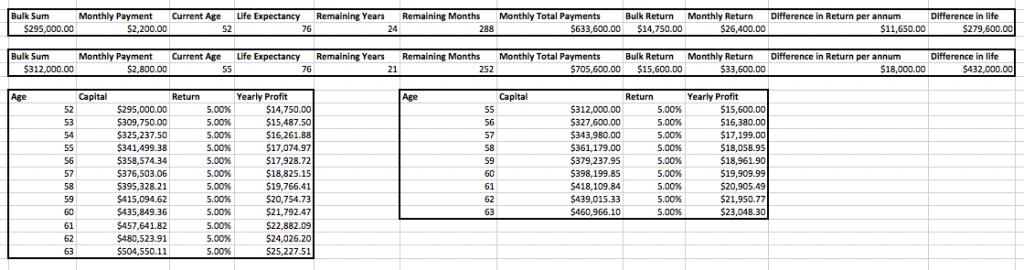

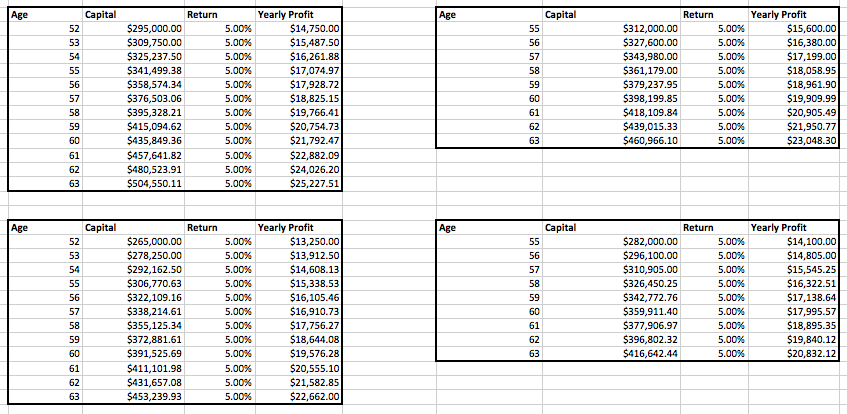

My dilemma is this......I can retire as an early retiree with reduced benefits that would pay me at approx. 2200 a month for the rest of my life. I could take a lump sum of approx. 295,000.00 and invest with Vanguard, MF's, IRA's etc....or I can "freeze" it till I am 55 which would put me at 2800 a month for the rest of my life or about 312,000K lump sum.

I took a huge pay cut in leaving police work....working hard to pay off debt. I have a wife that is 10 years younger than I. She is in the Air Force and works for the state of Oregon. So we have that to look forward to as well. We are currently using my wife's health insurance and can until she decides to retire 10 plus years down the road. My new job is only paying me about 48K a year as opposed to 74K......

My real dilemma is that I would like to at least have something to show for being spat on, having kids and adults die in my hands, almost being ran down on the highway etc.....such as a new vehicle.

In the state of Oregon we have PERS Tier system of which I am on the Tier 1 system. We also have an IAP account. This account has 60K in it. The tier one account has 240K....

Ideas anyone??

I have talked to 4 CFPs and all give me different scenarios / perspectives

Thanks in advance for you replies,

Krymedogg

Just retired after a 22 1/2 year stint as a deputy sheriff in Oregon. I am 52 years old and started working as an investigator for a public defender in Marion County where they do not have PERS.

My dilemma is this......I can retire as an early retiree with reduced benefits that would pay me at approx. 2200 a month for the rest of my life. I could take a lump sum of approx. 295,000.00 and invest with Vanguard, MF's, IRA's etc....or I can "freeze" it till I am 55 which would put me at 2800 a month for the rest of my life or about 312,000K lump sum.

I took a huge pay cut in leaving police work....working hard to pay off debt. I have a wife that is 10 years younger than I. She is in the Air Force and works for the state of Oregon. So we have that to look forward to as well. We are currently using my wife's health insurance and can until she decides to retire 10 plus years down the road. My new job is only paying me about 48K a year as opposed to 74K......

My real dilemma is that I would like to at least have something to show for being spat on, having kids and adults die in my hands, almost being ran down on the highway etc.....such as a new vehicle.

In the state of Oregon we have PERS Tier system of which I am on the Tier 1 system. We also have an IAP account. This account has 60K in it. The tier one account has 240K....

Ideas anyone??

I have talked to 4 CFPs and all give me different scenarios / perspectives

Thanks in advance for you replies,

Krymedogg