sgfgrover15

Dryer sheet aficionado

We are closing quickly in on the dates that we both RE and I am starting to have minor panic attacks. Well he is retiring, I am resigning and will take a lower retirement when I turn 55. Financially we will certainly be ok.

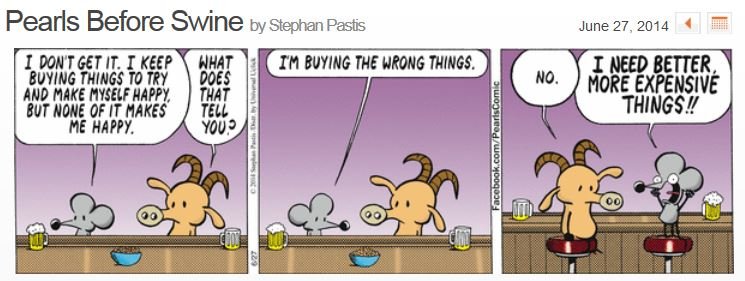

What I am struggling with right now is my needs vs. wants. H doesn't spend money or really have wants that cost much. I have always been awed by pink sparkly things and love to grab the latest kitchen gadget (ie: donut maker that cost $50 and you use once). In other words I like stuff because I like the high from acquiring it. Then have instant buyers remorse.

So that being said I find myself thinking (not out loud to H) well if I want to buy such and such or go here or there, H would work part time . So logically I know spending has to stop. But, emotionally I am really struggling with it. I guess what I am trying to ask did anyone struggle with the transition from "we make a great living and can buy what we want and travel when we want to" now "we will be on a fixed income and I have to live within my means.

. So logically I know spending has to stop. But, emotionally I am really struggling with it. I guess what I am trying to ask did anyone struggle with the transition from "we make a great living and can buy what we want and travel when we want to" now "we will be on a fixed income and I have to live within my means.

I know it sounds easy peasy and I am really trying to control the urge to shop. And before I buy anything I do the do I need this or do I want this? I don't spend time browsing on line or going to malls anymore so that has helped.

BUT I still get the tingling feeling that I want what I want and I want it now. H does know this and he feels that he isn't going to say no to me because we have worked hard, I did the lion's share of raising three children and didn't do for myself and now it is my turn.

Any advice on the transition? Other than pull up my big girl panties and control myself.

What I am struggling with right now is my needs vs. wants. H doesn't spend money or really have wants that cost much. I have always been awed by pink sparkly things and love to grab the latest kitchen gadget (ie: donut maker that cost $50 and you use once). In other words I like stuff because I like the high from acquiring it. Then have instant buyers remorse.

So that being said I find myself thinking (not out loud to H) well if I want to buy such and such or go here or there, H would work part time

. So logically I know spending has to stop. But, emotionally I am really struggling with it. I guess what I am trying to ask did anyone struggle with the transition from "we make a great living and can buy what we want and travel when we want to" now "we will be on a fixed income and I have to live within my means.

. So logically I know spending has to stop. But, emotionally I am really struggling with it. I guess what I am trying to ask did anyone struggle with the transition from "we make a great living and can buy what we want and travel when we want to" now "we will be on a fixed income and I have to live within my means.I know it sounds easy peasy and I am really trying to control the urge to shop. And before I buy anything I do the do I need this or do I want this? I don't spend time browsing on line or going to malls anymore so that has helped.

BUT I still get the tingling feeling that I want what I want and I want it now. H does know this and he feels that he isn't going to say no to me because we have worked hard, I did the lion's share of raising three children and didn't do for myself and now it is my turn.

Any advice on the transition? Other than pull up my big girl panties and control myself.

) has definitely impacted my desire to spulrge on more 'stuff'. I now prefer to spend on travel and 'experiences'.

) has definitely impacted my desire to spulrge on more 'stuff'. I now prefer to spend on travel and 'experiences'.