Dd852

Full time employment: Posting here.

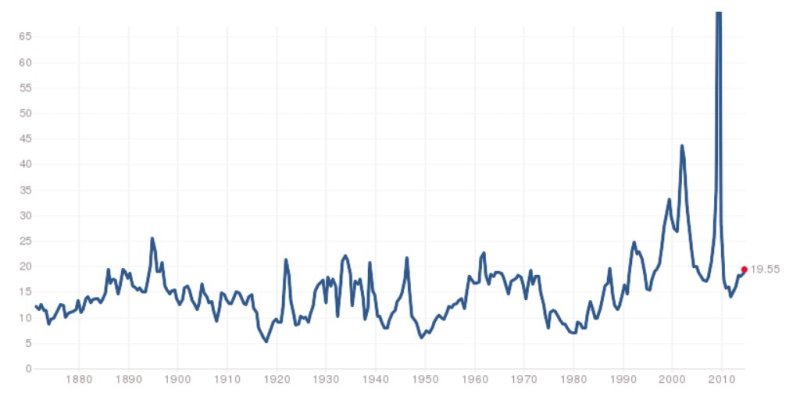

There's been a lot written recently about the dizzying heights of the market

Robert Shiller wrote this over the weekend in the NYT, which seemed unsettling.

I read an excellent response today, here

The bottom line, as usual, "... it would be very rash for anybody who is not certain that they can wait out the market to invest more than they can afford to lose. And past performance is not only not a guarantee it may not be an indicator of future results."

So keep enough liquid and cash-like that you can wait out bumps and crashes; don't get stampeded into selling into a bottom but hang on as long as you can; stay diversified; stay calm and disciplined.

Robert Shiller wrote this over the weekend in the NYT, which seemed unsettling.

I read an excellent response today, here

The bottom line, as usual, "... it would be very rash for anybody who is not certain that they can wait out the market to invest more than they can afford to lose. And past performance is not only not a guarantee it may not be an indicator of future results."

So keep enough liquid and cash-like that you can wait out bumps and crashes; don't get stampeded into selling into a bottom but hang on as long as you can; stay diversified; stay calm and disciplined.