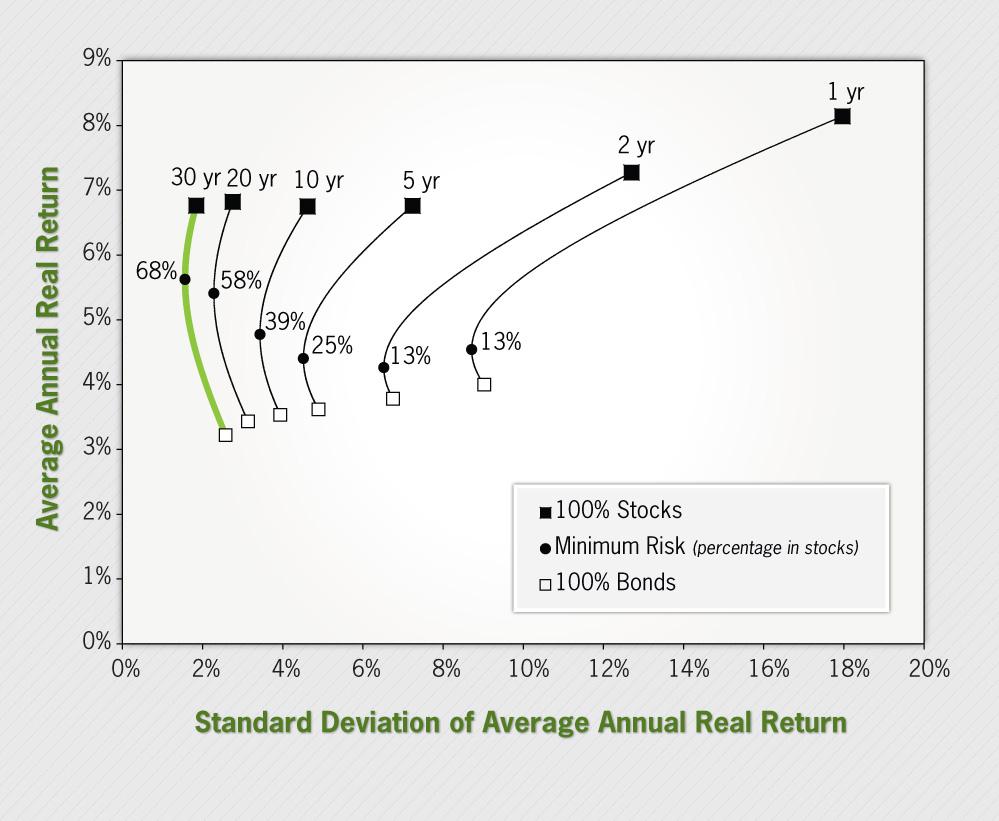

Jeremy Siegel, author of “Stocks for the Long Run“, had an article in the latest issue of the “AAII Journal” (American Association of Individual Investors) entitled “Real Returns Favor Holding Stocks.” The full article is a benefit available for members only, but perhaps the best part of the article was a chart showing the risk/return trade-offs (efficient frontiers) for stocks and bonds over various holding periods (1980-2012):

Marotta highlights important points from two of the graphs from in the article.

http://www.marottaonmoney.com/real-returns-favor-holding-stocks/