- Joined

- Oct 13, 2010

- Messages

- 10,735

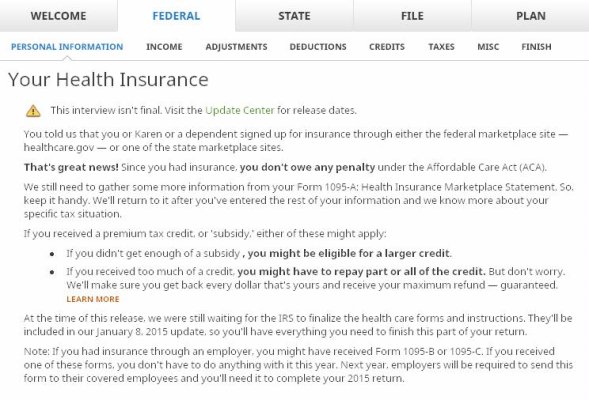

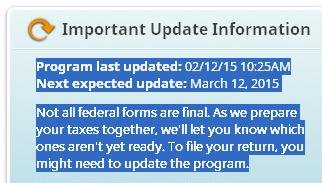

I'm not sure when it came out, but I see that H&R Block 2014 tax software is downloadable now.

Has anyone run through it? Does it handle the ACA subsidy balancing well? (or at all)? How about the ACA penalty calculation...is that in there?

I plan to run some "what-if" calculations and only then decide how much tIRA to Roth to convert, but that depends on the ACA calculations being in there.

Has anyone run through it? Does it handle the ACA subsidy balancing well? (or at all)? How about the ACA penalty calculation...is that in there?

I plan to run some "what-if" calculations and only then decide how much tIRA to Roth to convert, but that depends on the ACA calculations being in there.