Midpack

Give me a museum and I'll fill it. (Picasso) Give me a forum ...

I know the answer (often nowhere near enough), but thought I'd share a recent scary experience.

Had a beer with 3 people I've known for more than 15 years, one a good friend, the others acquaintances. One of the others just started as a Financial Advisor for a very well known national firm, I am leaving the name out deliberately (though if you recognize the attachment below...wink-wink). She is the only FA in her office, and tells me that's typical for that firm.

She got a BA in Business in the late 80's, but none of her previous work experience was even remotely related to finance or investing (she was mostly underemployed). She was telling us how much she's enjoying the new job, and how she constructs portfolios for clients for example - "it's really interesting, just like putting together pieces of a puzzle." She also talked about helping people plan for retirement, before and after.

I was the only DIY investor at the table, and I don't claim to be an expert - but it was clear she had very little knowledge of her new job. I'm convinced they've given her plug-n-chug software and/or contacts in a central office that are providing whatever expertise they may have to offer. Unfortunately you could learn more from the bogleheads wiki than she knows.

It was an eye opening evening. We'll remain friends, but we won't ever do business together.

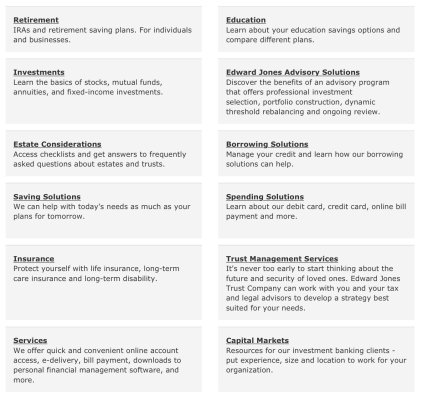

The services she offers:

Had a beer with 3 people I've known for more than 15 years, one a good friend, the others acquaintances. One of the others just started as a Financial Advisor for a very well known national firm, I am leaving the name out deliberately (though if you recognize the attachment below...wink-wink). She is the only FA in her office, and tells me that's typical for that firm.

She got a BA in Business in the late 80's, but none of her previous work experience was even remotely related to finance or investing (she was mostly underemployed). She was telling us how much she's enjoying the new job, and how she constructs portfolios for clients for example - "it's really interesting, just like putting together pieces of a puzzle." She also talked about helping people plan for retirement, before and after.

I was the only DIY investor at the table, and I don't claim to be an expert - but it was clear she had very little knowledge of her new job. I'm convinced they've given her plug-n-chug software and/or contacts in a central office that are providing whatever expertise they may have to offer. Unfortunately you could learn more from the bogleheads wiki than she knows.

It was an eye opening evening. We'll remain friends, but we won't ever do business together.

The services she offers:

Attachments

Last edited: