First, let me just say that I think FIREcalc is an excellent resource, and that Early Retirement.org is providing a tremendous service by making it available and maintaining it. The simulator's use of actual historical returns is far superior to Monte Carlo models that fail to account for mean reversion.

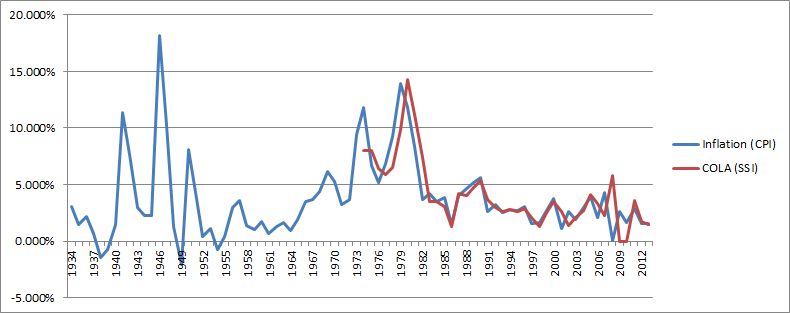

I'm writing because I think there may be an issue in the way the model handles Social Security payments during deflationary periods. I haven't been able to find any discussion of this in past threads. If it is an issue, (and I'm not sure it is) then FIREcalc may be significantly overestimating the size of withdrawals that should be taken from retiree portfolios during periods characterized by deflation. I've run a number of FIRECALC simulations and looked at the Excel results spreadsheet for a number of periods covering the 19th century, and the 1920s and 1930s, when we experienced deflation. It appears, based on the results I saw for Social Security payments in Column D, that these payments are being deflated in years characterized by deflation. My understanding is that, by law, the Social Security COLA adjustment cannot cause payments to decrease. Instead, payments are held constant in years when the CPI goes down instead of up. (In fact, this happened, I think in 2009 or 2010 (based on the deflation of 2008). It was in the news, because seniors complained that they weren't receiving a COLA adjustment, and I believe the Obama Administration actually floated the idea of a small upward adjustment despite the decline in the CPI.)

If this is an issue, it can make a significant difference in the numerator of the withdrawal rate. For example, from 1929 to 1933 deflation reduced the cost of living by about 25%. Say a person retired in 1929 with total expenses of $10,000, and Social Security of $5,000 (the example is hypothetical, since 1929 pre-dates Social Security). If Social Security is assumed to decline along with total expenses by 25%, then by 1933 we have the numerator in the withdrawal rate = 0.75 x $10,000 - 0.75 x $5,000 = $3,750. But if SS is instead held constant at $5,000, we have 0.75 x $10,000 - $5,000 = $2,500. Instead of a 25% reduction in the numerator, there is a 50% reduction.

I stumbled on the impact of the treatment of SS during deflation when playing around with my own (crude) historical simulator. I was running a test based on the above example, to see the impact of delaying SS from age 62 to age 70. I was stunned at what I saw for the 1929-59 time series. With the $5,000 SS payment delayed, it increased by 76% (plus the inflation that occurred after 1933) to $9,620, while total expenses declined to $8,248--so the numerator in the withdrawal rate actually went negative 8 years into retirement, and remained negative for the rest of the retirement! In other words, a retiree would no longer have to make withdrawals from his or her portfolio, but would instead be able to save money throughout retirement (or go to Vegas? )

)

Having looked at the FIRECALC results spreadsheets, and recalculating the SS payments during deflationary years, in addition to 1929-59 it appears that periods beginning in the early years of the 20th century (between roughly 1901 to 1920) could be significantly affected. This was a real rough patch for stocks (Panic of 1907, WWI and high inflation), but in my tests I saw that a number of retirements that began in these years and ran out of money in the 1920s and 1930s at a starting withdrawal rate of 5% were saved from bankruptcy when the SS payments were held constant during the deflationary years. The combination of the stock market boom plus the deflation during the 1920s helped keep the portfolios from failing, once SS payments were no longer deflated along with expenses.

I apologize if this isn't an issue or has been previously discussed.

Chris M

I'm writing because I think there may be an issue in the way the model handles Social Security payments during deflationary periods. I haven't been able to find any discussion of this in past threads. If it is an issue, (and I'm not sure it is) then FIREcalc may be significantly overestimating the size of withdrawals that should be taken from retiree portfolios during periods characterized by deflation. I've run a number of FIRECALC simulations and looked at the Excel results spreadsheet for a number of periods covering the 19th century, and the 1920s and 1930s, when we experienced deflation. It appears, based on the results I saw for Social Security payments in Column D, that these payments are being deflated in years characterized by deflation. My understanding is that, by law, the Social Security COLA adjustment cannot cause payments to decrease. Instead, payments are held constant in years when the CPI goes down instead of up. (In fact, this happened, I think in 2009 or 2010 (based on the deflation of 2008). It was in the news, because seniors complained that they weren't receiving a COLA adjustment, and I believe the Obama Administration actually floated the idea of a small upward adjustment despite the decline in the CPI.)

If this is an issue, it can make a significant difference in the numerator of the withdrawal rate. For example, from 1929 to 1933 deflation reduced the cost of living by about 25%. Say a person retired in 1929 with total expenses of $10,000, and Social Security of $5,000 (the example is hypothetical, since 1929 pre-dates Social Security). If Social Security is assumed to decline along with total expenses by 25%, then by 1933 we have the numerator in the withdrawal rate = 0.75 x $10,000 - 0.75 x $5,000 = $3,750. But if SS is instead held constant at $5,000, we have 0.75 x $10,000 - $5,000 = $2,500. Instead of a 25% reduction in the numerator, there is a 50% reduction.

I stumbled on the impact of the treatment of SS during deflation when playing around with my own (crude) historical simulator. I was running a test based on the above example, to see the impact of delaying SS from age 62 to age 70. I was stunned at what I saw for the 1929-59 time series. With the $5,000 SS payment delayed, it increased by 76% (plus the inflation that occurred after 1933) to $9,620, while total expenses declined to $8,248--so the numerator in the withdrawal rate actually went negative 8 years into retirement, and remained negative for the rest of the retirement! In other words, a retiree would no longer have to make withdrawals from his or her portfolio, but would instead be able to save money throughout retirement (or go to Vegas?

)

)Having looked at the FIRECALC results spreadsheets, and recalculating the SS payments during deflationary years, in addition to 1929-59 it appears that periods beginning in the early years of the 20th century (between roughly 1901 to 1920) could be significantly affected. This was a real rough patch for stocks (Panic of 1907, WWI and high inflation), but in my tests I saw that a number of retirements that began in these years and ran out of money in the 1920s and 1930s at a starting withdrawal rate of 5% were saved from bankruptcy when the SS payments were held constant during the deflationary years. The combination of the stock market boom plus the deflation during the 1920s helped keep the portfolios from failing, once SS payments were no longer deflated along with expenses.

I apologize if this isn't an issue or has been previously discussed.

Chris M