Just wondering what the rooms thought of how the market has been reacting ?

Are you moving in or out or holding

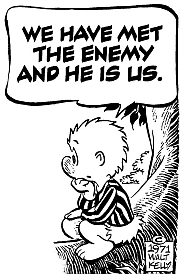

Fear of a correction, I not sure what to think. I am holding firm and still buying bi monthly . Thought has crossed my mind to move to cash

Sent from my iPhone using Early Retirement Forum

Are you moving in or out or holding

Fear of a correction, I not sure what to think. I am holding firm and still buying bi monthly . Thought has crossed my mind to move to cash

Sent from my iPhone using Early Retirement Forum

It does help keep the male hormones more manageable.

It does help keep the male hormones more manageable.