On Tuesday, Federal regulators confirmed that an HHS notice issued in May is correct. The clarification impacts 2016 non-grandfathered plans.

From the HHS notice:A consumer who purchases a family health insurance plan will have an out-of-pocket cost of $6,850 for themselves or for a single family member – the same amount as someone with individual coverage. A family cap of $13,700 would apply if more than one person in a family submits claims.

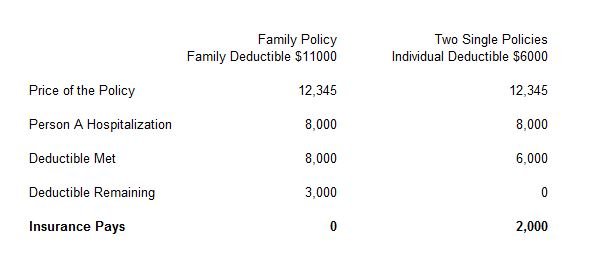

This means after a patient has paid $6,850 in individual copays, coinsurance and deductibles, the health insurance company is then responsible for 100 percent of the total remaining costs.

The Department of Health and Human Services, Treasury and Labor, wrote in Tuesday’s letter, that this rule keeps consumers from being penalized for choosing family coverage rather than individual coverage.

HHS clarified that under section 1302(c)(1) of the Affordable Care Act, the self-only maximum annual limitation on cost sharing applies to each individual, regardless of whether the individual is enrolled in self-only coverage or in coverage other than self-only......

Example: Assume that a family of four individuals is enrolled in family coverage under a group health plan in 2016 with an aggregate annual limitation on cost sharing for all four enrollees of $13,000 (note that a plan is permitted to set an annual limitation below the maximum established under section 1302(c)(1), which is an aggregate $13,700 limitation for coverage other than self-only for 2016). Assume that individual #1 incurs claims associated with $10,000 in cost sharing, and that individuals #2, #3, and #4 each incur claims associated with $3,000 in cost sharing (in each case, absent the application of any annual limitation on cost sharing). In this case, because, under the clarification discussed above, the self-only maximum annual limitation on cost sharing ($6,850 in 2016) applies to each individual, cost sharing for individual #1 for 2016 is limited to $6,850, and the plan is required to bear the difference between the $10,000 in cost sharing for individual #1 and the maximum annual limitation for that individual, or $3,150. With respect to cost sharing incurred by all four individuals under the policy, the aggregate $15,850 ($6,850 + $3,000 + $3,000 + $3,000) in cost sharing that would otherwise be incurred by the four individuals together is limited to $13,000, the annual aggregate limitation under the plan, under the assumptions in this example, and the plan must bear the difference between the $15,850 and the $13,000 annual limitation, or $2,850.